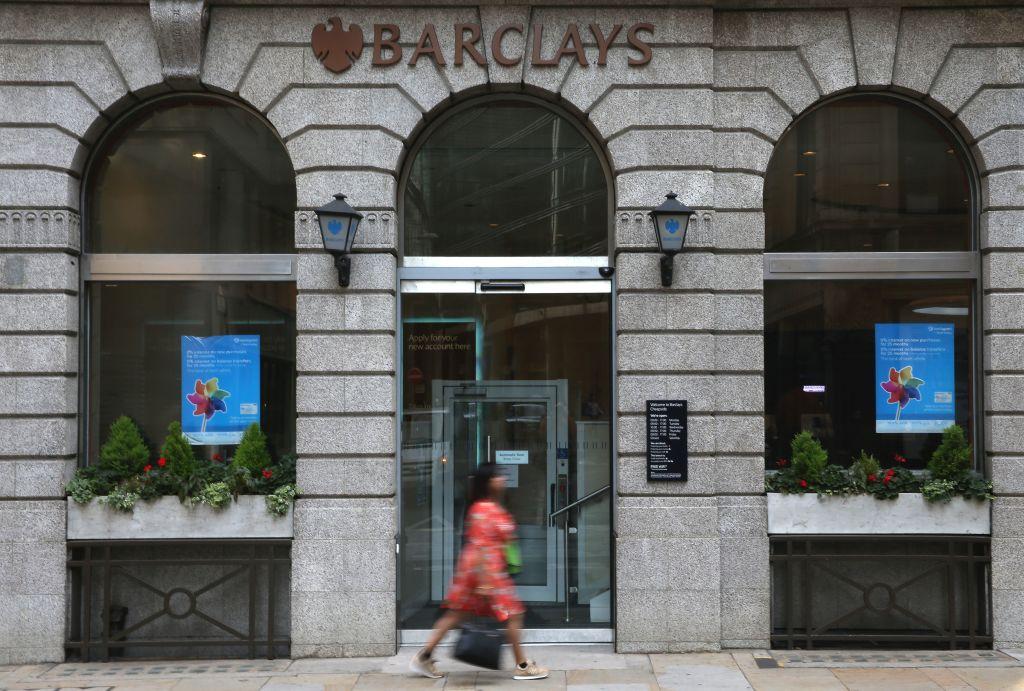

LONDON—Three former Barclays bankers cheated the global financial system to gain an unfair edge over counterparties in a five-year plot to rig Euribor interest rates, a London prosecutor alleged on Jan. 15.

James Waddington, a lawyer for the UK Serious Fraud Office, said the defendants were part of an elite, well-paid group that fixed the odds in a zero-sum game as he opened the prosecution’s case in a criminal trial expected to last at least two months.