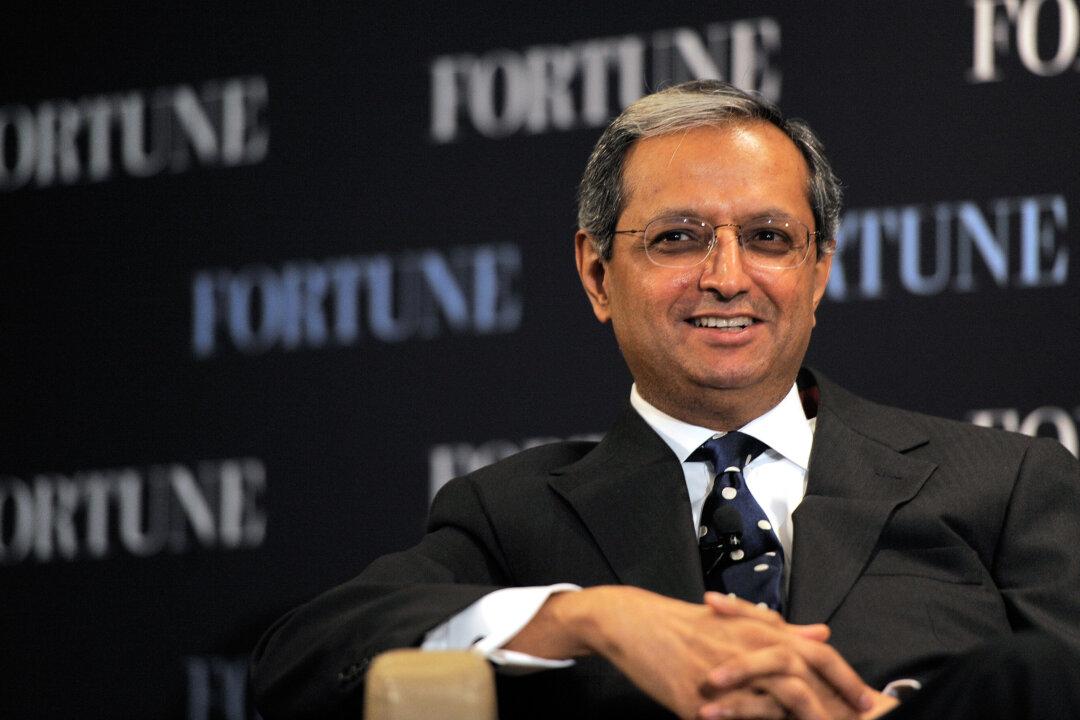

Every major financial institution will be thinking about trading cryptocurrencies within the next few years, according to Vikram Pandit, chairman of The Orogen Group and former chief executive officer of Citigroup Inc.

Speaking at the Singapore Fintech Festival event, Pandit told Bloomberg that in “one to three years, every large bank and/or securities firm is going to actively think about ’shouldn’t I also be trading and selling cryptocurrency assets?'”