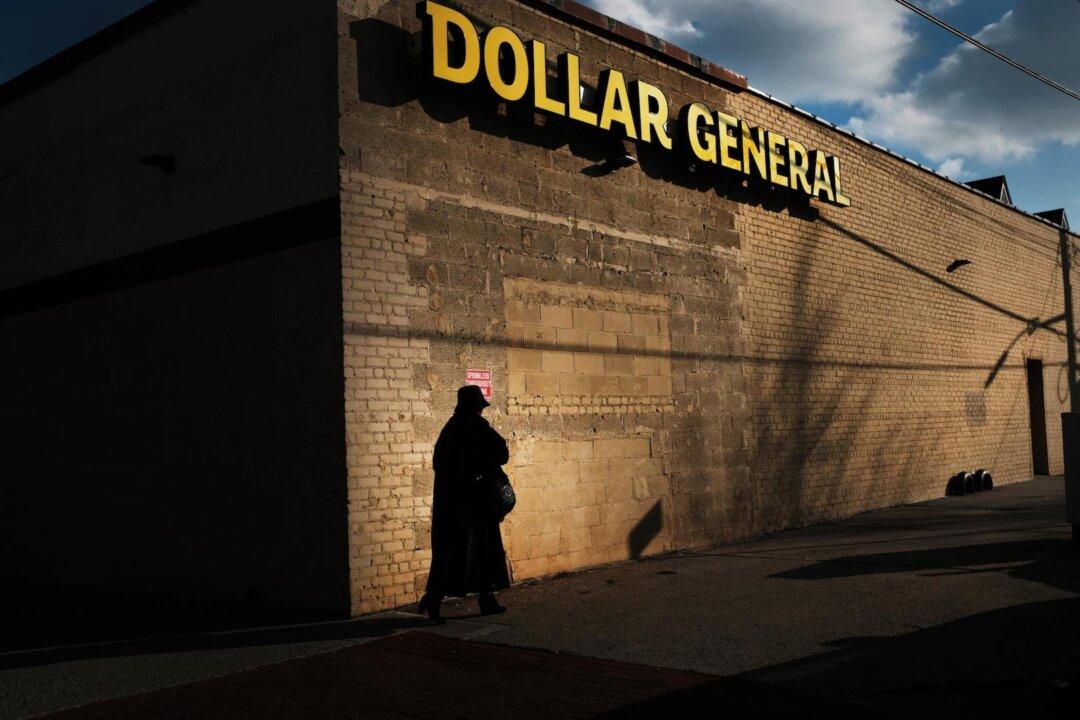

Dollar General Corp. shares dropped 12 percent by Monday afternoon after the company posted a weaker-than-anticipated earnings report for the second quarter, while also issuing a warning about consumer trends and theft.

The company said it expects net sales growth between 1.3 percent and 3.3 percent, down from a prior expectation of 3.5 percent to 5 percent. It also expects fiscal 2023 same-store sales growth to range from a 1 percent decline to 1 percent growth, which is also down from previous expectations, according to a news release.