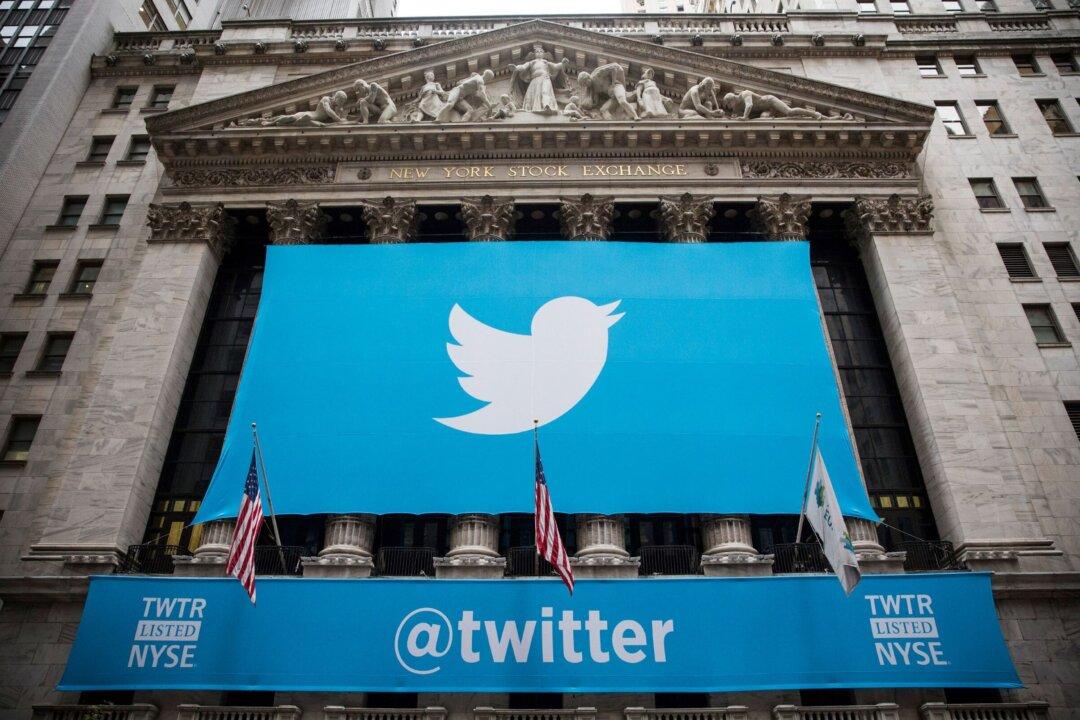

Twitter Inc shares are up 30.4 percent this week after Tesla Inc CEO and world’s richest man Elon Musk disclosed a new 9.2 percent ownership stake in Twitter and announced on Tuesday joined Twitter’s board of directors.

Musk tweeted he is already “working with [Twitter CEO Parag Agrawal] & Twitter board to make significant improvements to Twitter in coming months!”