A major proxy advisory firm has recommended Disney shareholders support one of the company’s rival nominees in the upcoming dictator board elections.

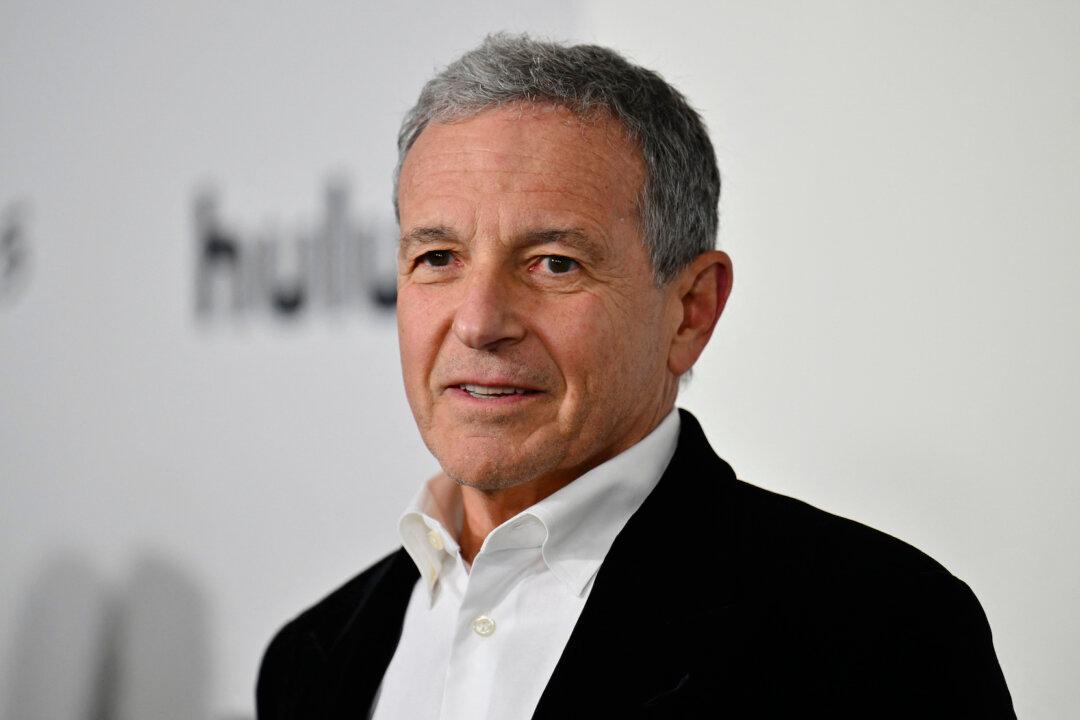

On April 3, Disney shareholders will cast their votes to choose new board members. Disney has announced 12 nominees, including Bob Iger, its chief executive officer. Activist investment firm Trian Fund Management, which has a $3.5 billion stake in the company, has nominated two individuals to the board—its co-founder Nelson Peltz and former Disney chief financial officer Jay Rasulo.