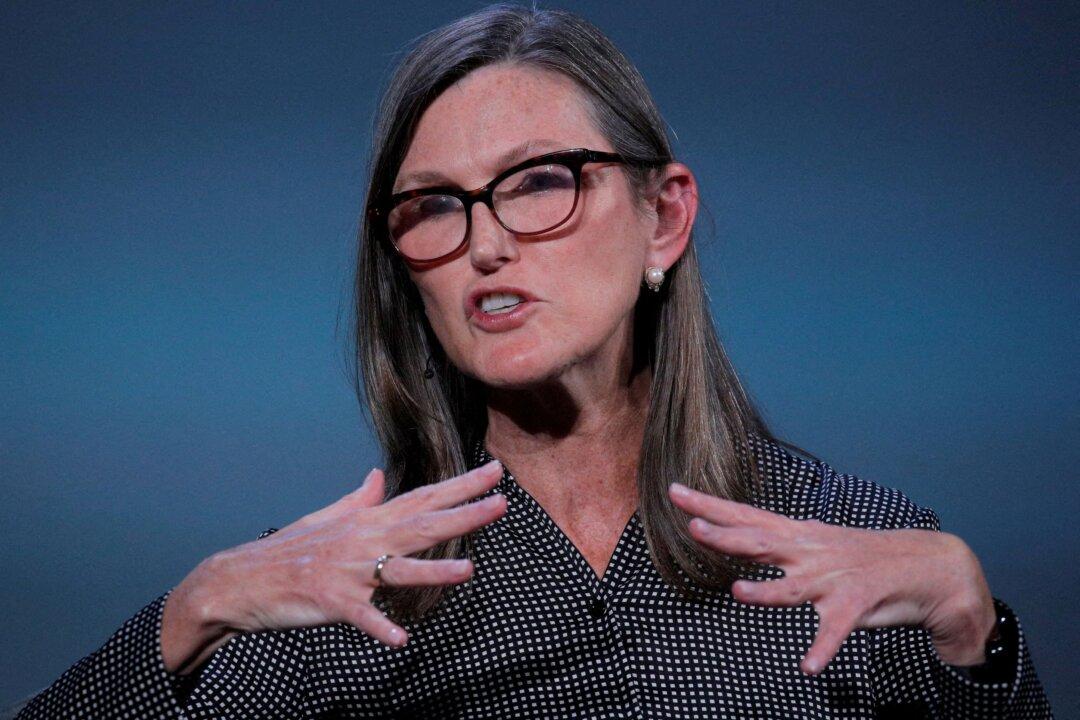

Star stock picker and noted Tesla Inc. bull Cathie Wood’s ARK Invest took advantage of a slump in the electric-car maker’s shares following its results, piling into the stock after months of paring back holdings.

The investment company bought 33,482 Tesla shares on Thursday, worth nearly $28 million based on the stock’s last closing price, across its flagship ARK Innovation ETF and the ARK Next Generation Internet ETF funds.