OTTAWA—Canada’s federal Budget 2019 included a new program to help first-time homebuyers along with other selected measures while keeping a key metric of the nation’s indebtedness on a declining trend.

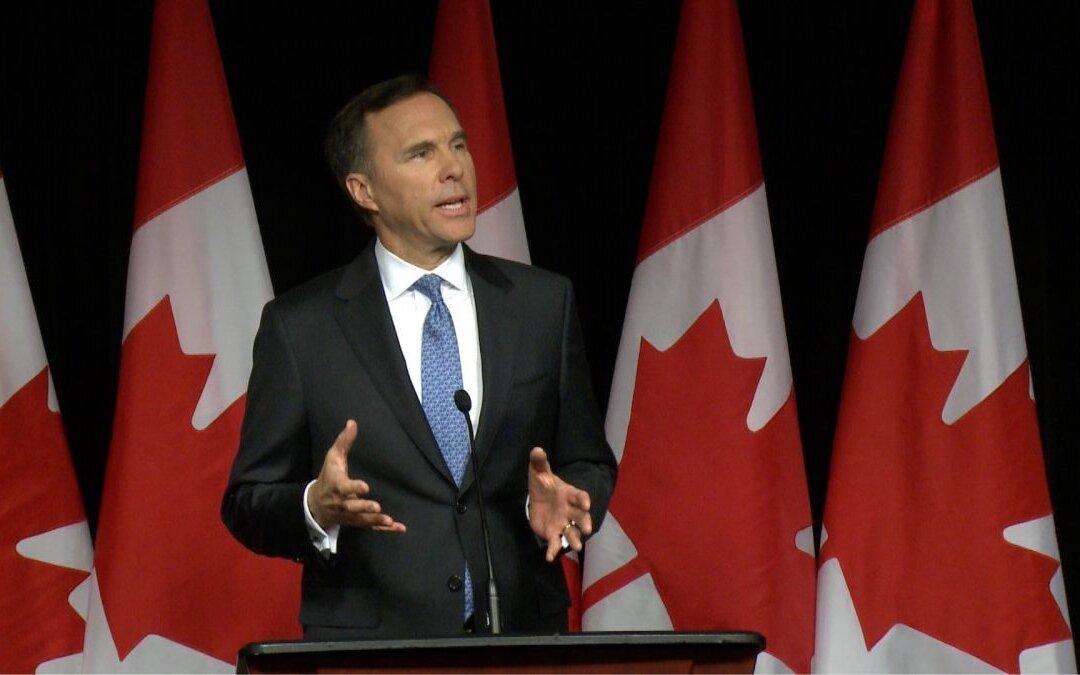

“I want to be very clear that this is a budget for people and for communities all across this country,” Morneau said in his speech in the House of Commons.