The Biden administration announced a new rule that would reclassify millions of gig workers across the country as employees, a move that could squeeze small businesses.

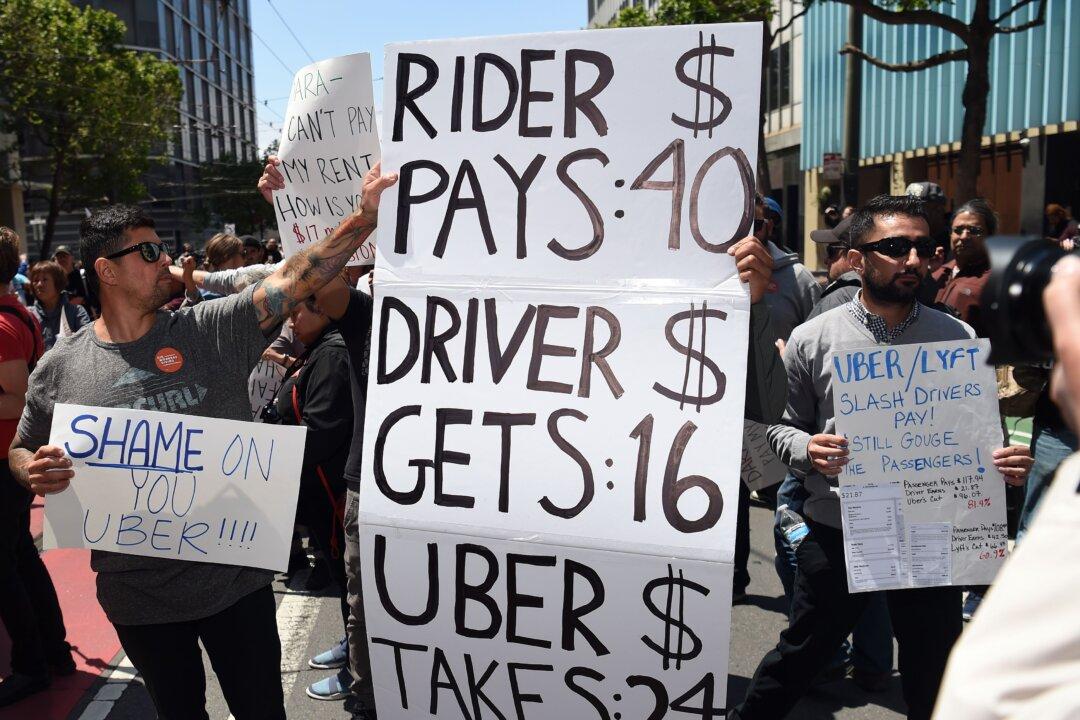

The Labor Department’s proposal, released on Oct. 11, will make it more difficult for companies to label workers independent contractors, with consequences for ride and delivery services, along with other industries that rely on employees in that work category.