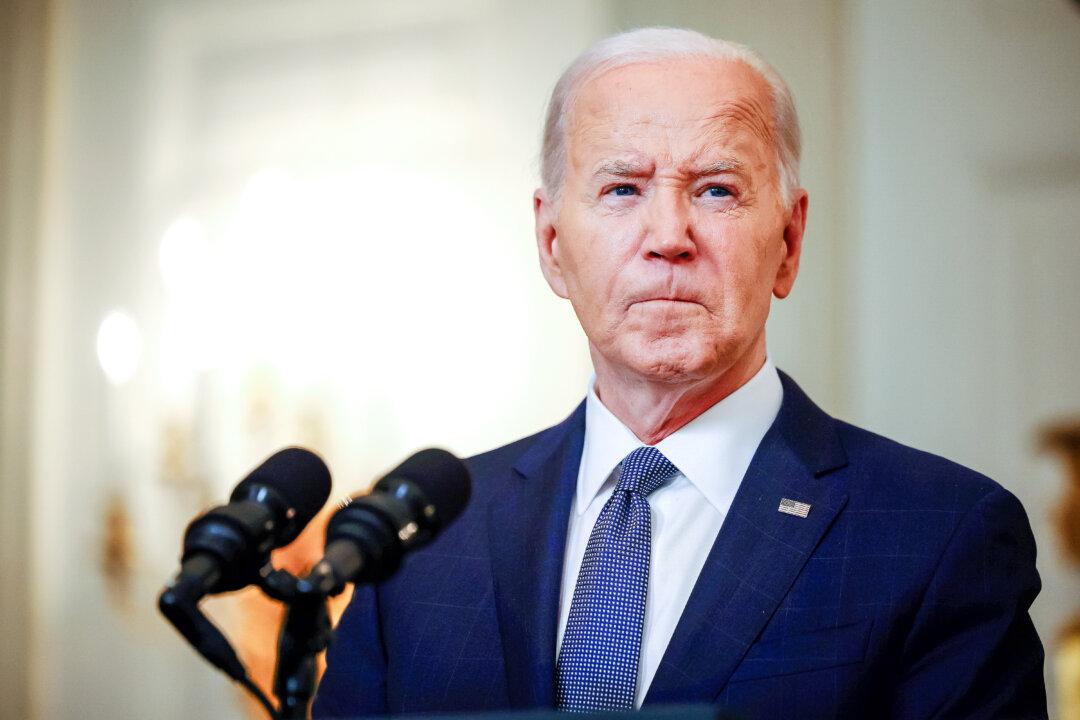

President Joe Biden and former President Donald Trump added trillions of dollars to the 10-year debt on net, according to a new analysis by the Committee for a Responsible Federal Budget (CRFB) released on June 24.

The nonprofit public policy organization published the findings of a new study comparing the fiscal policies of the two administrations, using data from the Congressional Budget Office (CBO) and the Office of Management and Budget (OMB). The organization assessed the presidents’ key actions and the 10-year impact with interest.