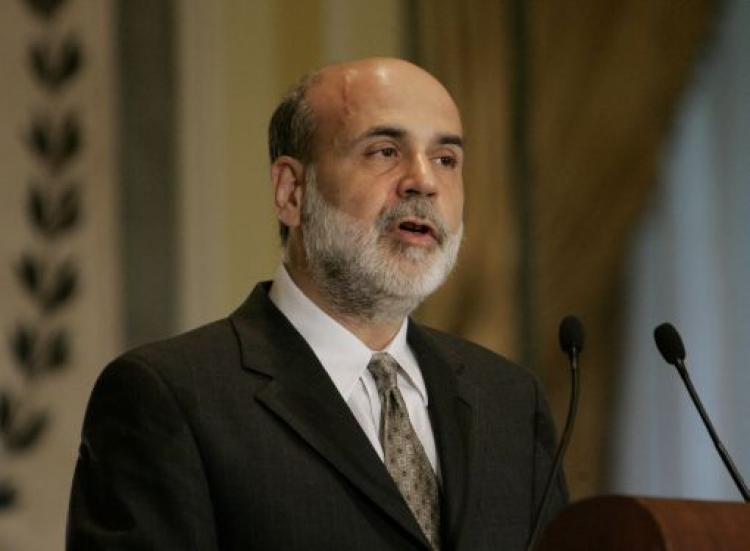

The Federal Reserve’s slow response to the global inflation crisis “was a mistake,” said Former Federal Reserve Chairman Ben Bernanke during an appearance on CNBC that aired on May 16.

Bernanke said that the central bank’s slow response to inflation has allowed the crisis to escalate into one of the worst periods in financial history since the early 1980s.