An arbitration board has ruled in favor of U.S. Steel, allowing its proposed acquisition by Japan’s Nippon Steel to proceed despite stiff opposition from the U.S. company’s labor union.

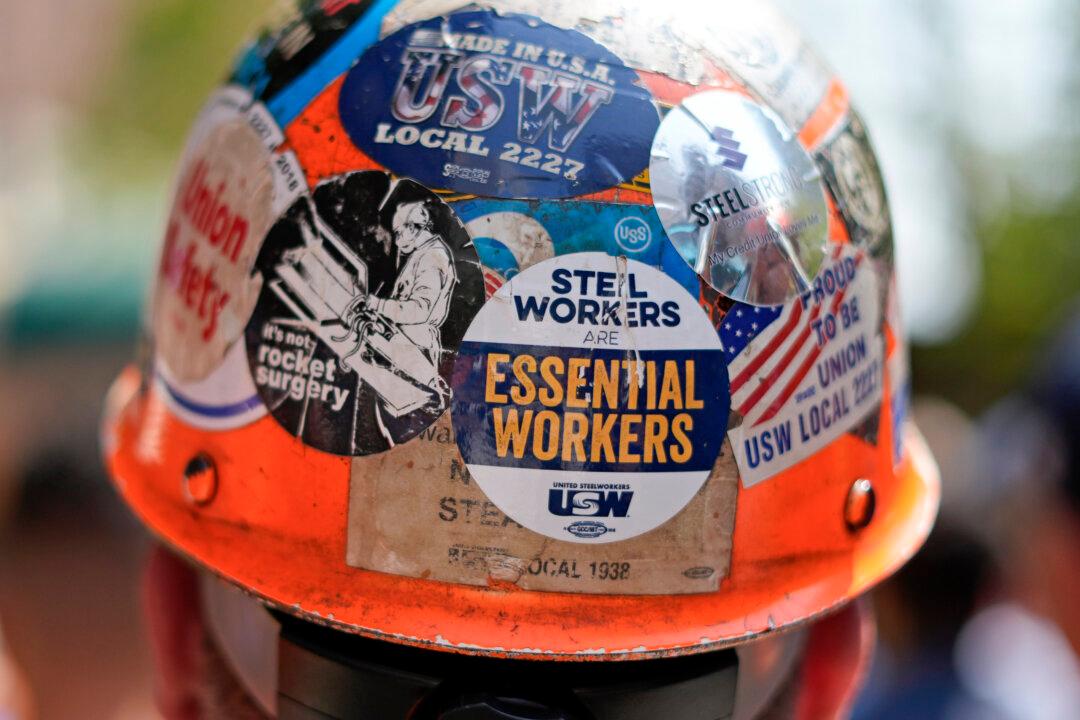

The board, jointly selected by U.S. Steel and the United Steelworkers (USW) union to settle disputes between the two related to their Basic Labor Agreement (BLA), announced on Sept. 25 that U.S. Steel had met its obligations under the agreement’s successorship clause. As a result, no further action under the BLA is necessary for Nippon Steel to assume U.S. Steel’s union-related agreements and move forward with the transaction.