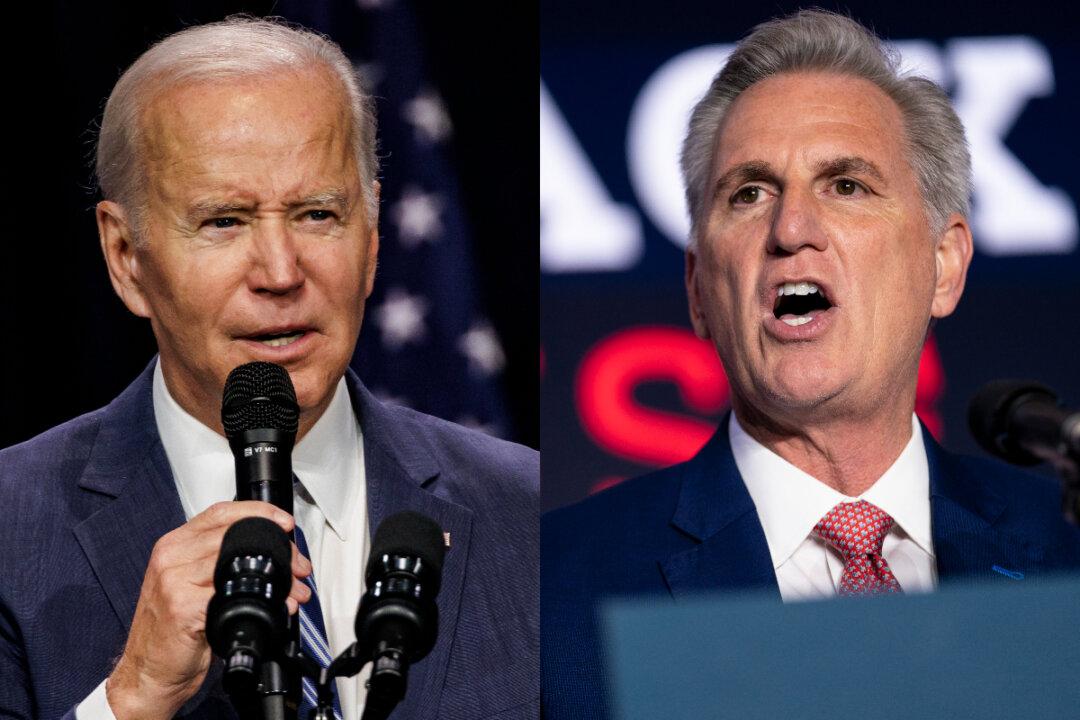

House Speaker Kevin McCarthy has thrown down the gauntlet at President Joe Biden and the Democrats over the debt ceiling.

McCarthy has said he will extend the debt ceiling through May 2024, to $32.9 trillion, but only if the president and Congressional Democrats agree to:

- return roughly $50 to $60 billion of unspent COVID-19 funding to the Treasury;

- return spending to 2022 levels;

- roll back the Inflation Reduction Act that passed last year;

- defund the planned “army” of IRS agents, as well as other funding for the agency; and

- mandate a work requirement for Food Stamp and Medicaid recipients.