Shares of Nvidia, the leading AI chipmaker, dropped by 10 percent, sparked by investor concerns over the U.S. economy and the future of artificial intelligence.

This decline wiped $279 billion from the company’s market value, setting a record for the largest one-day loss by any company in U.S. stock market history.

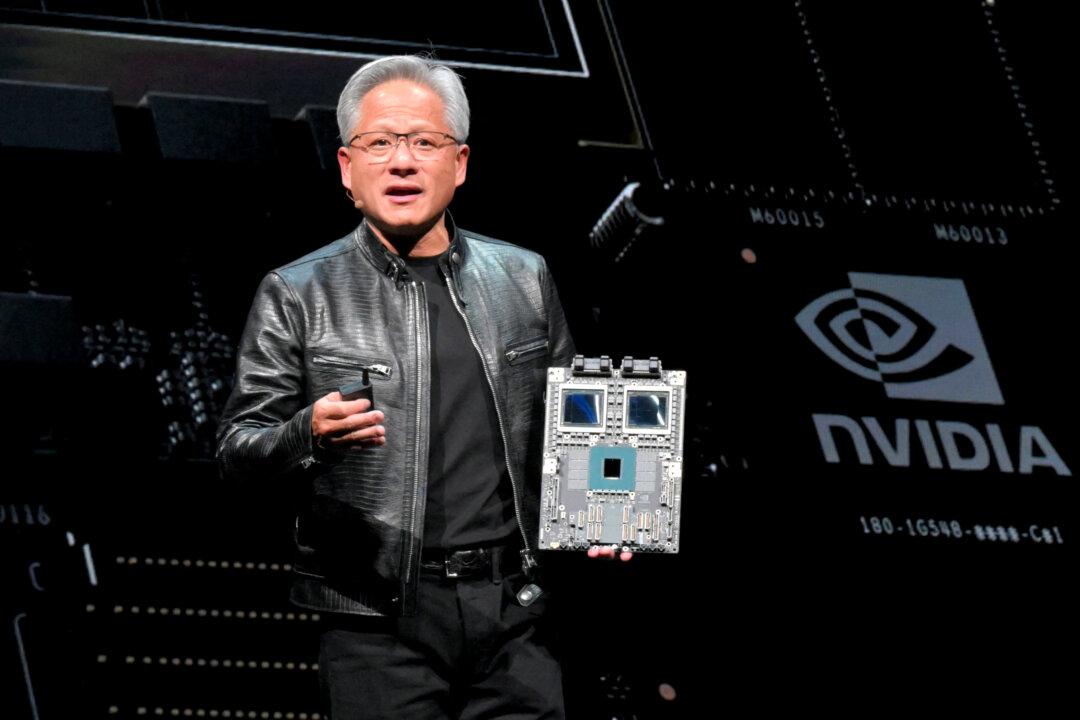

Nvidia is at the center of the massive artificial intelligence (AI) boom as the company engineers advanced chips, systems, and software for the AI factories of the future.

Nvidia

The losses came after Nvidia was sold heavily overnight as investors reacted to concerns about the growth of the AI sector, as well as U.S. economic growth.Other U.S. tech giants, including Alphabet, Apple, and Microsoft, also saw their shares fall on Sept. 3.

The FTSE 100 index, which comprises the largest companies on the London Stock Exchange, dropped by 0.76 percent in early trading, with major European indexes also down.

Nvidia’s quarterly financial results and forecasts, announced last week, disappointed investors, despite that its sales doubled.

Antitrust

On Sept. 3, Bloomberg, citing unnamed sources, reported that the U.S. Department of Justice had sent a subpoena to Nvidia regarding its antitrust practices.Nvidia holds about 80 percent of the AI chip market.

Last month, the Department of Justice opened an investigation into the company following complaints from competitors that it had abused its market dominance.

“Nvidia wins on merit, as reflected in our benchmark results and value to customers, who can choose whatever solution is best for them,” a spokesperson for the company told Reuters.

“What can the DOJ really say here? They can’t go and tell Nvidia to stop innovating. I think another factor here is Intel,” he said.

Intel used to dominate the United States chip industry, but it is now facing mounting financial issues after it posted a $7 billion operating loss last year.

“Intel has been struggling, but that’s not Nvidia’s fault. There isn’t a clear antitrust case in the U.S. based on this,” Belle said.

Reacting to the slump, Jason Teh, chief investment officer at Vertium Asset Management in Sydney, told Reuters: “When you look at Nvidia as a market leader, it’s not holding up despite very strong profits. There’s an old saying—if the troops can’t follow the generals, it’s a warning sign. If the Nvidias, Apples, and Microsofts cannot hold up the market, that’s it—we’re in a bear market.”

Michael Green, a portfolio manager at Simplify in the San Francisco Bay Area, said that some investors might be adjusting their exposure to tech giants such as Nvidia.

“People are over-allocated to Nvidia and many of these names, and they’re trying to reduce that exposure. It just has the potential for these things to sell off quite significantly,” he told Reuters.

The Epoch Times contacted Nvidia and the U.S. Department of Justice for comment.