Commentary

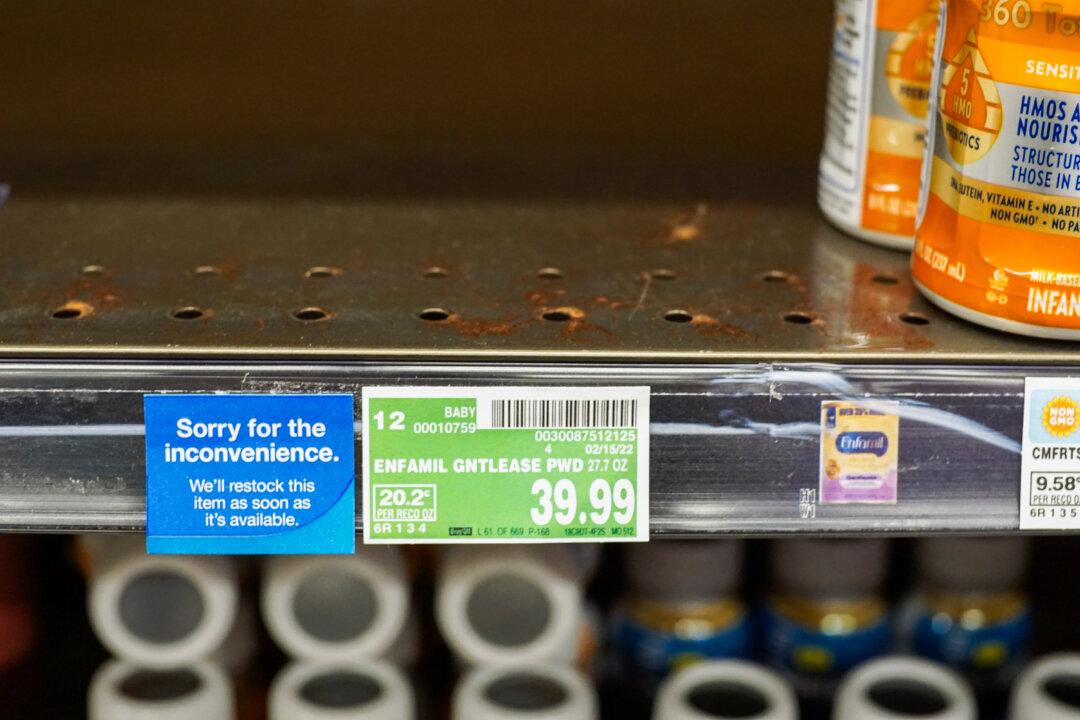

For more than a year now, the major economic story hasn’t been inflation but rather supply. This was primarily due to governments around the world overreacting to the pandemic, so businesses the world over found it exceedingly difficult to respond to recovering (sometimes boosted) economies. In very basic economics (small “e”), such inelasticity on the supply side means prices are the only factors to adjust to any change in demand.