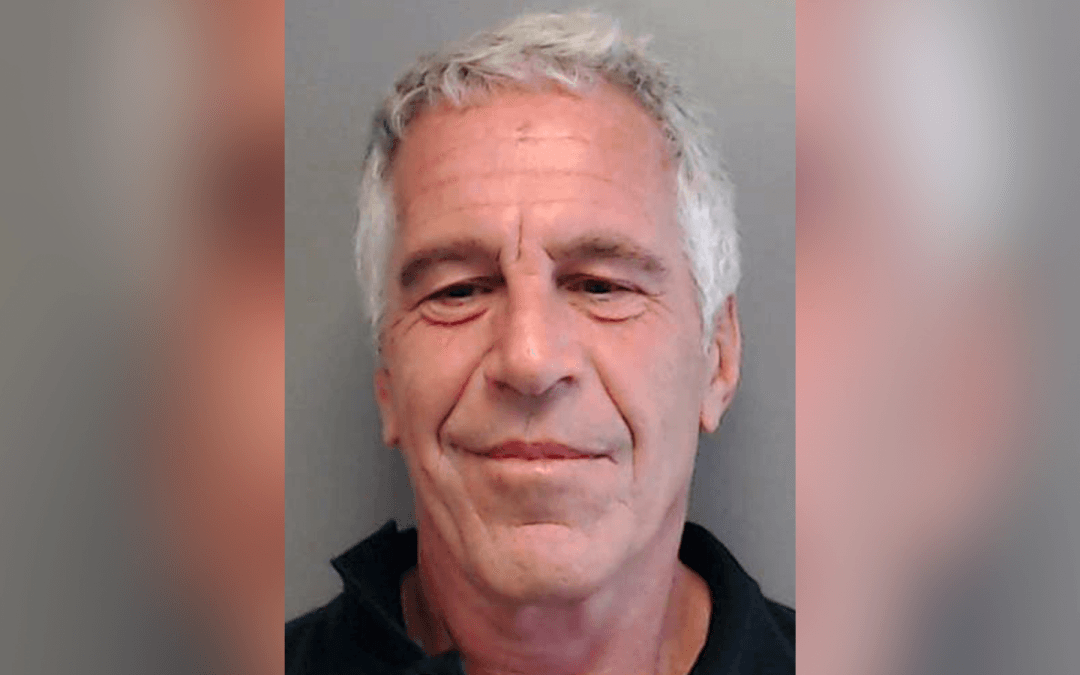

At least 20 women who were victims of sex trafficking and sexual abuse at Jeffrey Epstein properties were paid through JPMorgan Chase accounts, according to a new court filing.

The women were allegedly abused and trafficked at properties in the U.S. Virgin Islands, New York, and elsewhere between 2003 and 2019.