In comparison with those of Western economies, China’s countermeasures against the 2008 financial crisis were more drastic. While in the United States the balance sheet of the banking system increased by $4 trillion in the years after the global financial crisis, the balance sheet of the Chinese banking system expanded by $20 trillion in the same period. For reference, this is four times the Japanese GDP.

Did the Chinese authorities take excessive risks in fighting the crisis? As most of the “stimulus” was created within the state-run banking system and without market incentives for risk management, the safe bet is yes.

China’s bank balance sheets amount to more than 600 percent of GDP and they have doubled in terms of percentage of GDP in the past several years.

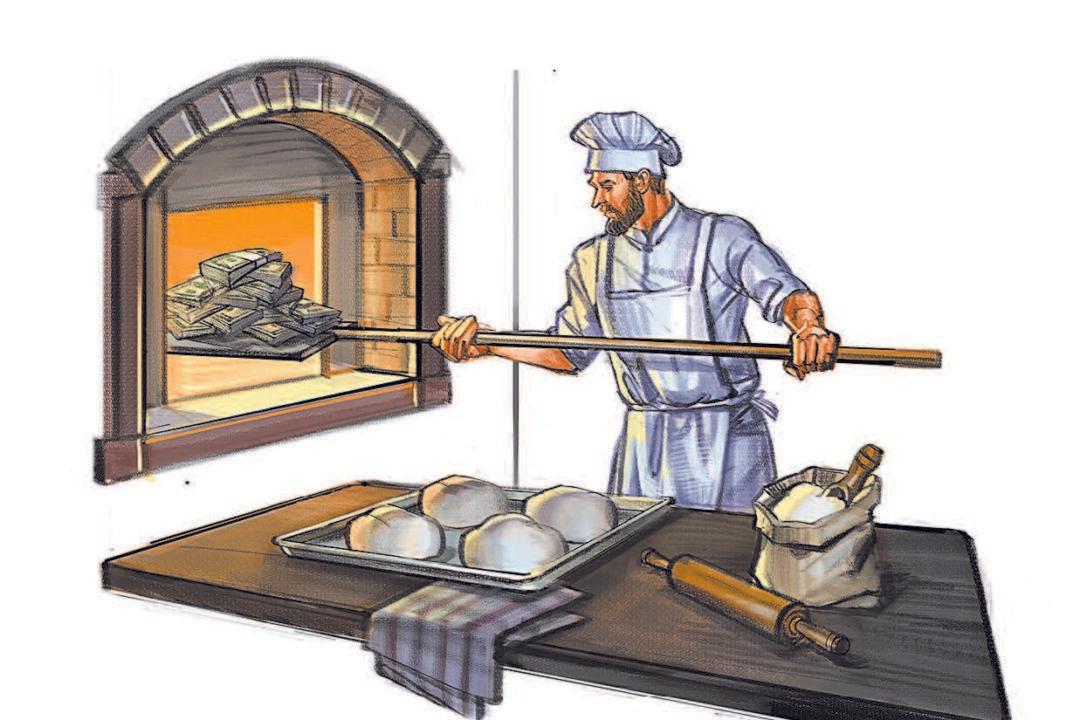

Too Much Debt

Condor Capital expects non-performing loan (NLP) ratios to rise in China, with estimated credit losses of $2.7 trillion to $3,5 trillion for China’s banks. By comparison, the losses of the global banking system since the 2008 financial crisis have been almost moderate at $1.5 trillion.

The most recent crisis does teach us, however, that the Chinese are prepared to take drastic measures if necessary. China fought the financial crisis by flooding the credit markets through the state-run banking system. In one year, total credit grew by as much as 35 percent on the basis of a classic Keynesian spending program.

Ronald-Peter Stöferle is managing partner and portfolio manager at European asset management firm Incrementum AG.

Author’s Selected Articles