Commentary

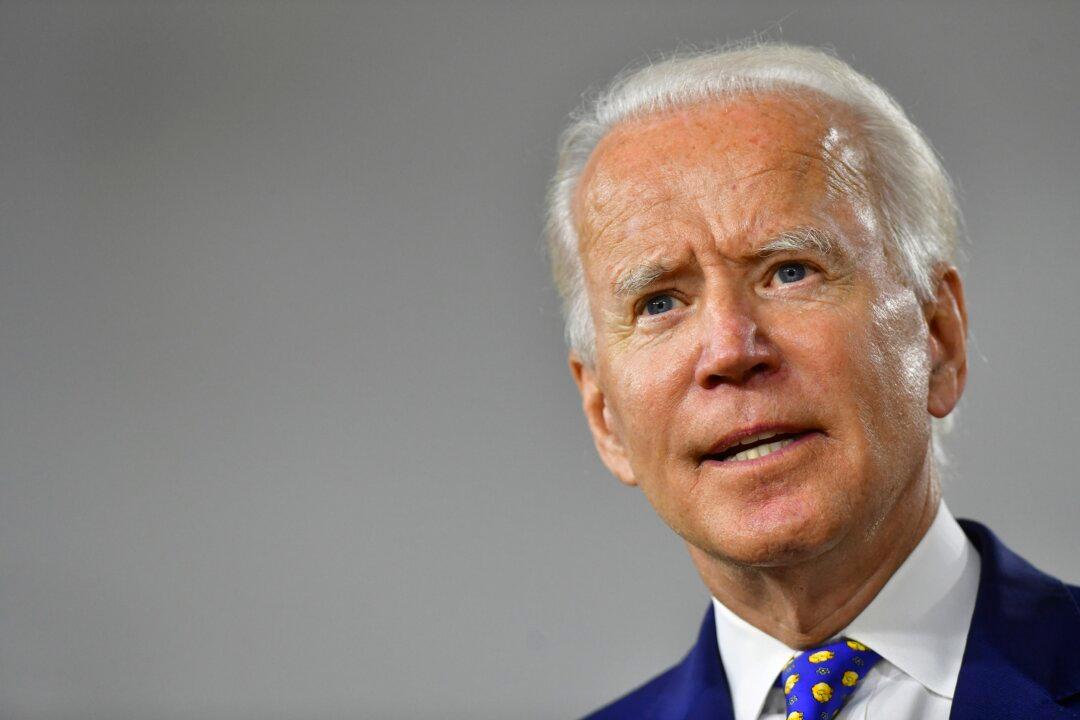

Who is going to win the November election? Well, some are seizing on polls showing a lead for former Vice President Joe Biden.

Who is going to win the November election? Well, some are seizing on polls showing a lead for former Vice President Joe Biden.