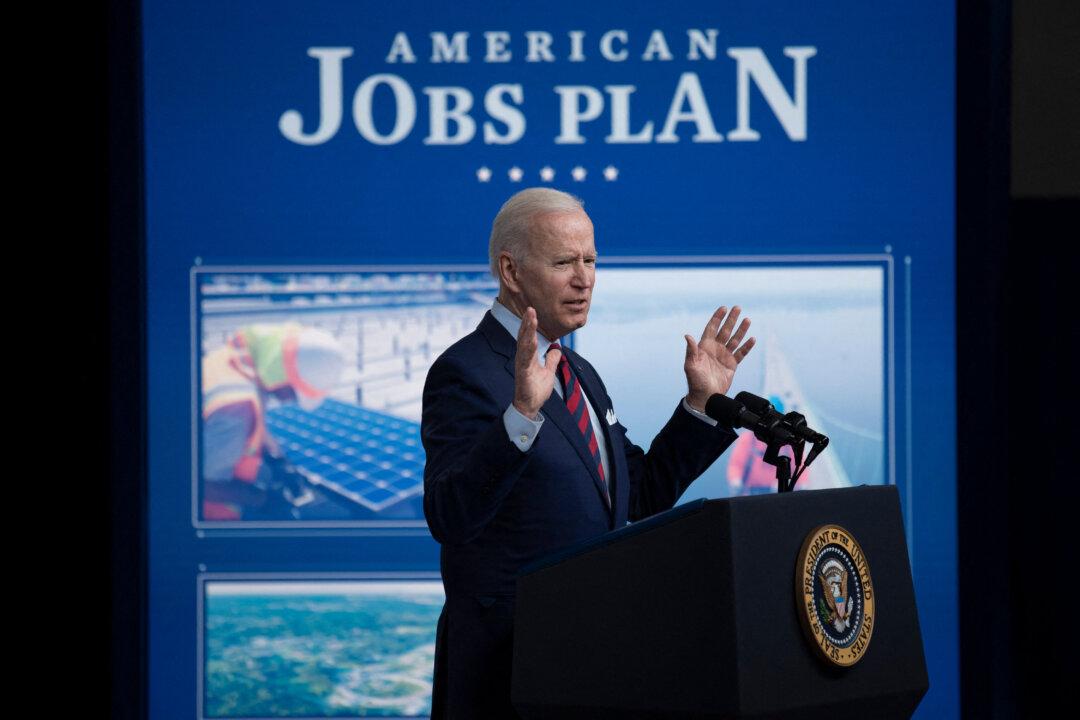

The combined tax-and-spend features of the Biden administration’s proposed infrastructure package—the American Jobs Plan (AJP)—would lead to weaker economic growth and fewer jobs, a tax policy think tank estimates.

The Washington-based Tax Foundation, a nonpartisan group that often subjects high tax policies to critical scrutiny, said in a new analysis that the AJP would shave about a 0.5 percentage point off long-run economic growth and result in 101,000 fewer jobs than the current baseline.