WASHINGTON—The U.S. government and the Federal Reserve this spring implemented unprecedented monetary and fiscal stimulus to address the economic fallout from the pandemic. The federal government is expected to pass more stimulus after the election as both President Donald Trump and presidential candidate Joe Biden have proposed additional actions to respond to the health and economic crises.

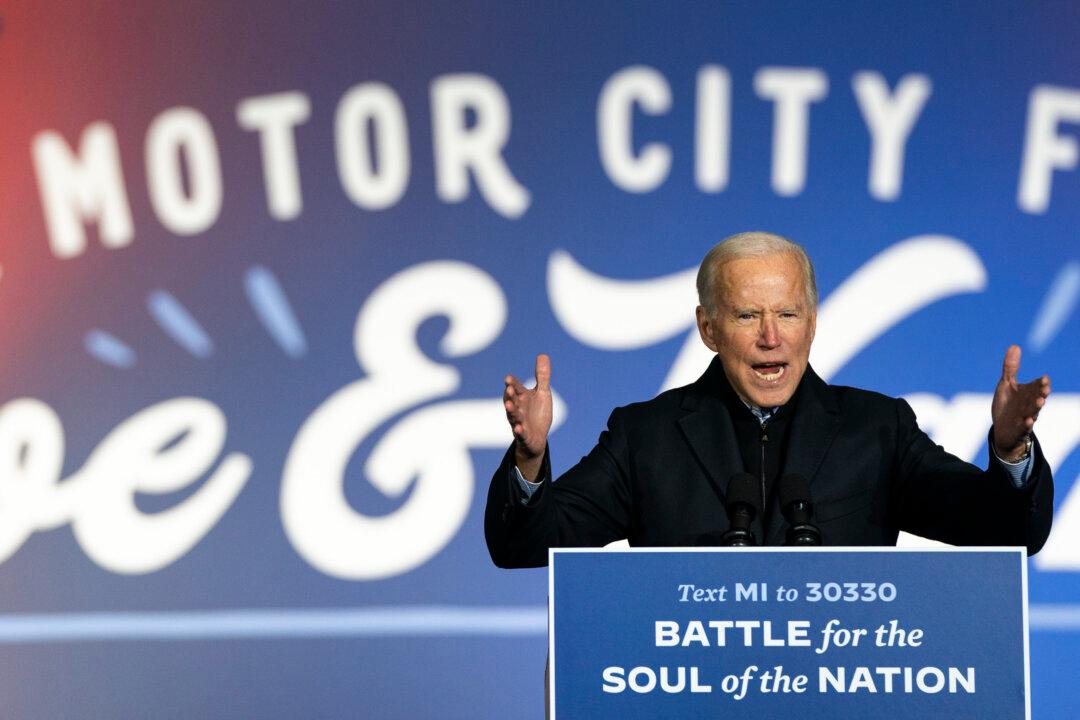

A new paper by the Committee for a Responsible Budget shows the sharp contrast between the costs of proposals from Trump and his Democratic opponent Biden.