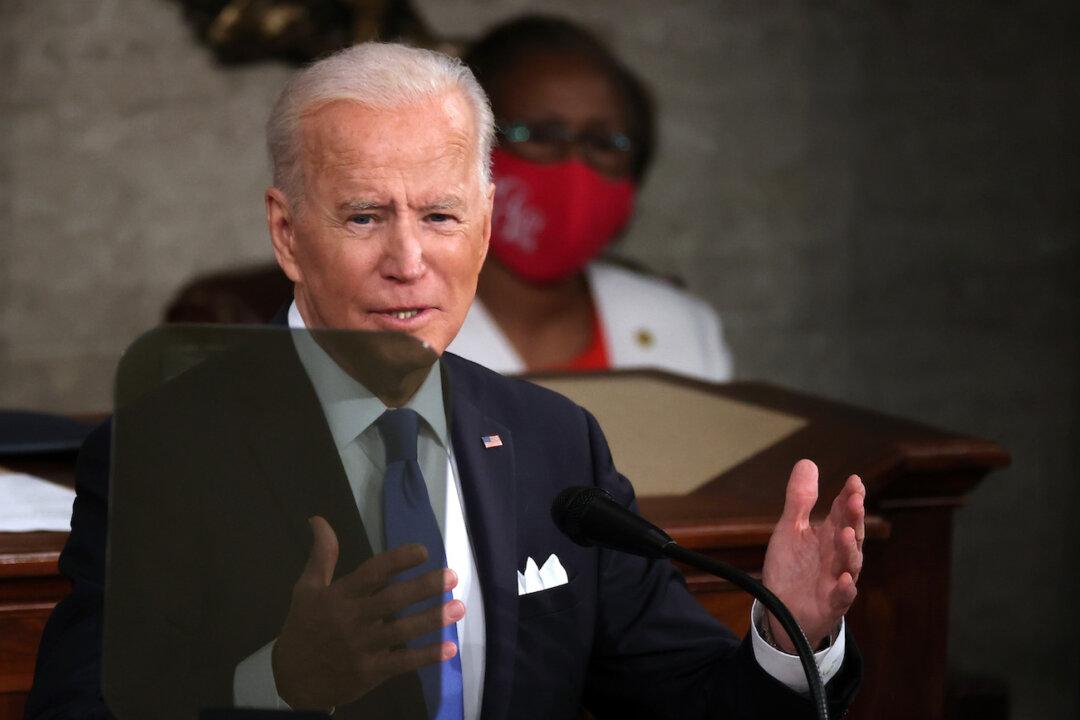

WASHINGTON—Ahead of his first address to a joint session of Congress, on April 28, President Joe Biden rolled out his third spending proposal, the American Families Plan, which, according to liberals, would be a “great achievement” if passed by Congress.

Opponents, however, criticize Biden’s massive spending plan, calling it the largest expansion of the welfare state since the Great Society programs of the 1960s.