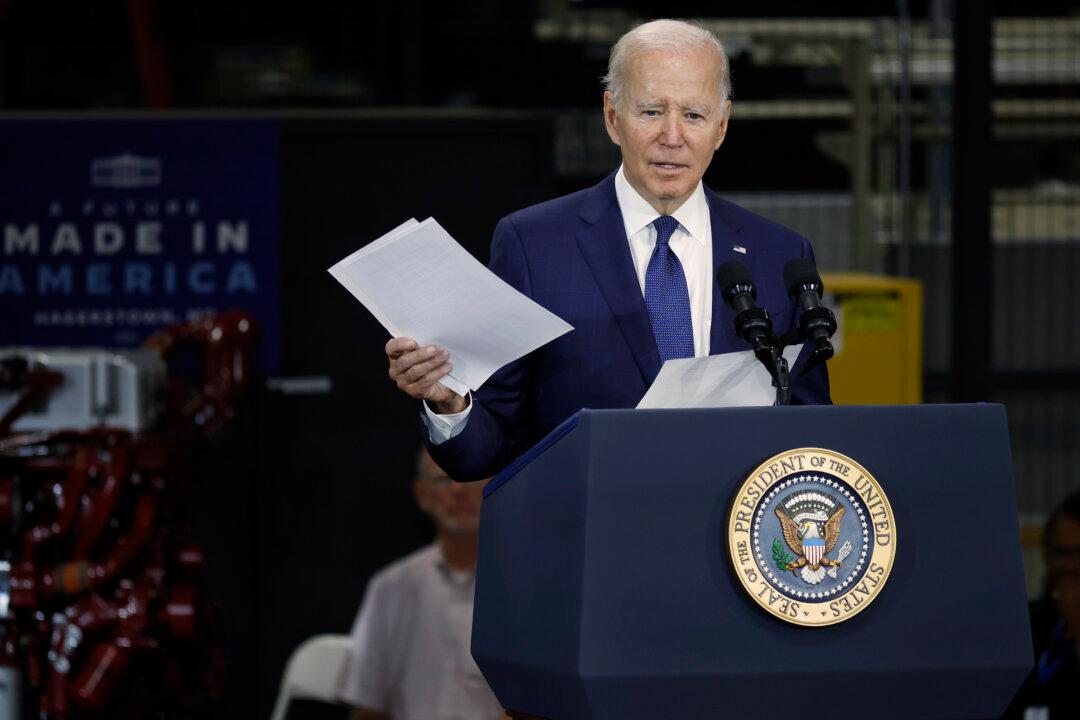

President Joe Biden admitted on Tuesday there’s a possibility a “very slight recession” could happen in the near future, though he reiterated that he doesn’t believe it will actually happen in the United States.

In an interview aired on “CNN Tonight,” Biden said Americans shouldn’t be afraid amid growing risk and fear of a global recession, arguing the United States is “in a better position” economically than any other major country in the world.