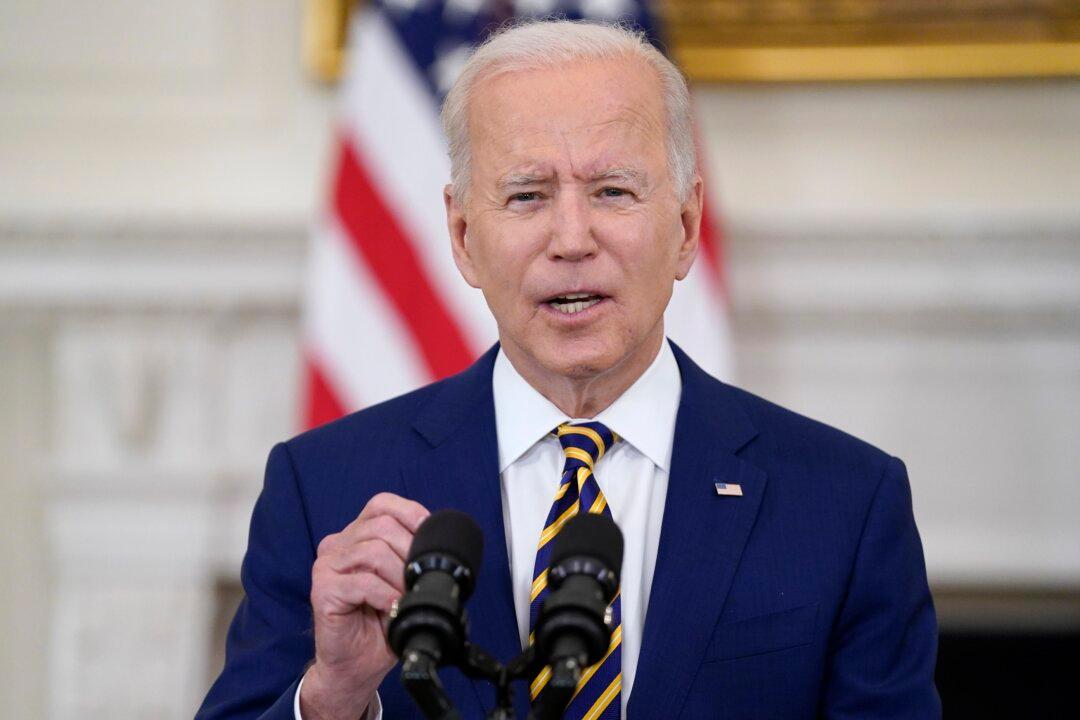

President Joe Biden said Monday that families will begin receiving part of the expanded child tax credit via advance payments starting July 15, while reiterating his intent to push for the benefit to become permanent, saying next month’s payments are “just the first step.”

Biden made the remarks in a statement on the day the White House officially designated as Child Tax Credit Awareness Day, with the president touting the tax relief measure as a way to “give our nation’s hardworking families with children a little more breathing room when it comes to putting food on the table, paying the bills, and making ends meet.”