Commentary

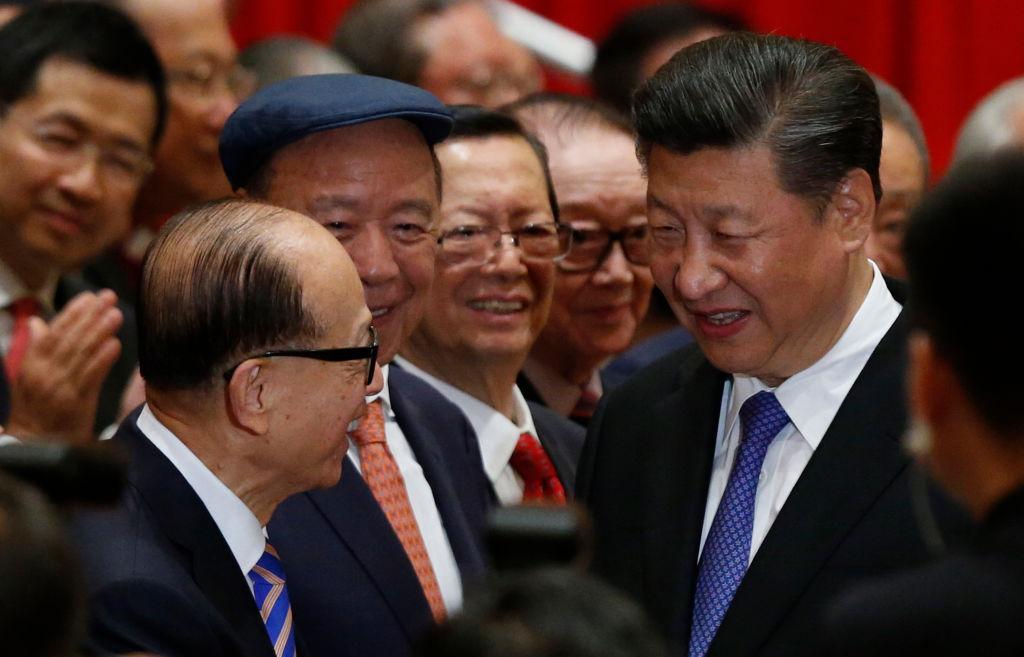

The family company of Hong Kong’s richest man Li Ka-shing recently sold a large amount of European assets. His investments have always been an economic bellwether. At this time, the confrontation between the United States and China has intensified, Chinese stocks and the Chinese stock market have seen ups and downs, and international capital has begun to move away from China.