UK banks must not close individuals’ accounts for political reasons, Rishi Sunak has warned in a row sparked by Nigel Farage.

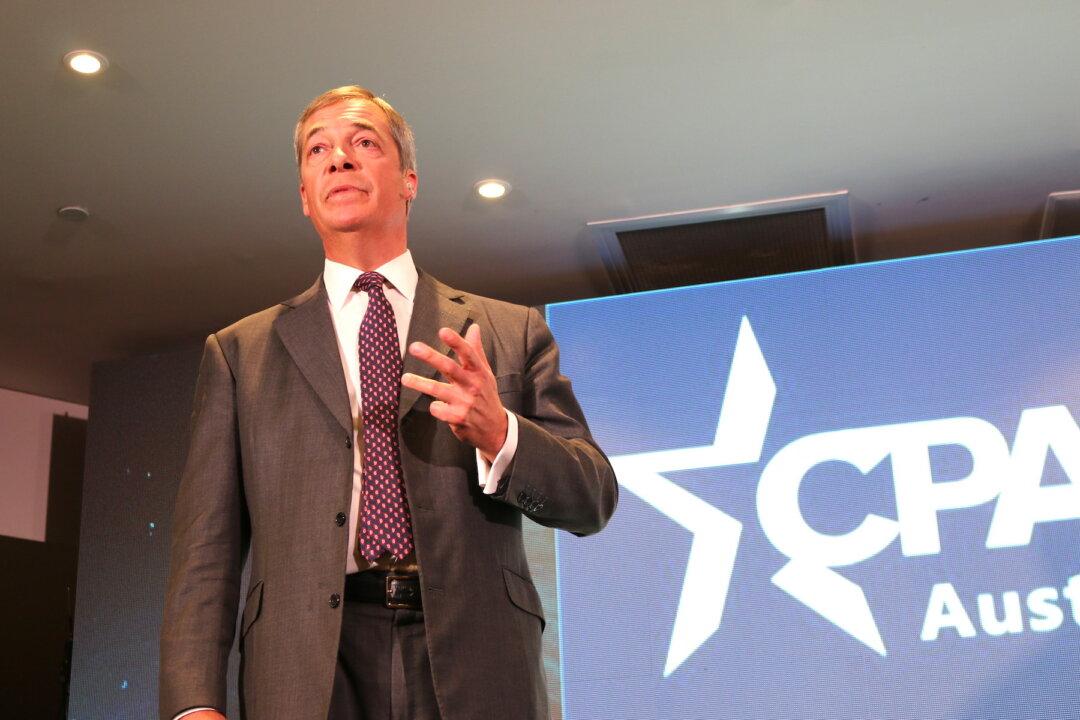

Last week, the British political leader Nigel Farage claimed that the bank he has been with for over 40 years has closed his bank account with “no explanation.