The Bank of Canada is moving out of its research phase into a central bank digital currency and going into the development phase, its governor said on Dec. 12, with public consultations on the issue to take place in 2023.

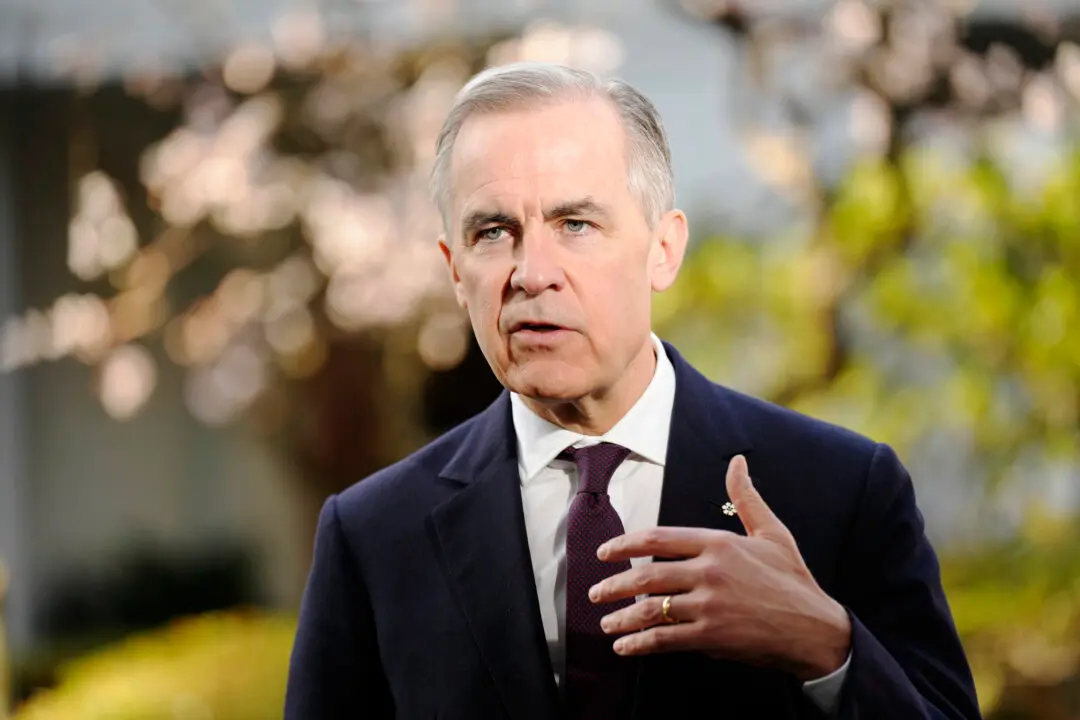

“I think over time, it is conceivable that in a more digital economy, it might make sense to give Canadians the ability to hold central bank money in digital format, so we’re making sure we’re getting ready,” Bank of Canada (BoC) Governor Tiff Macklem said in his year-end address hosted by the Business Council of British Columbia.