Australian house prices have regained their growth momentum in March after falling for ten consecutive months due to the impact of interest rate hikes.

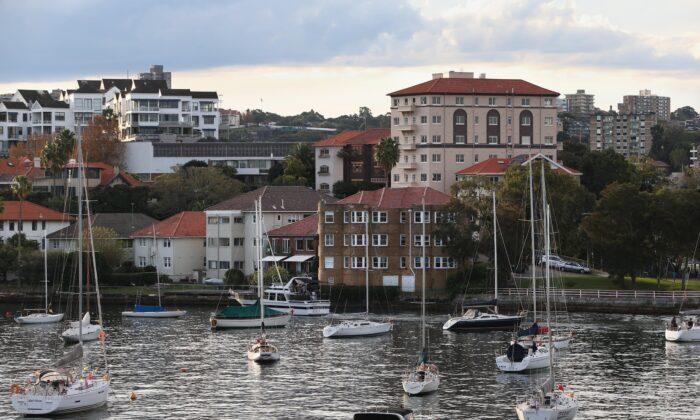

Sydney Leads in House Prices Growth

Sydney led the country with a 1.4 percent growth in house prices, followed by Melbourne at 0.6 percent, Perth at 0.5 percent and Brisbane at 0.1 percent.In contrast, Tasmania saw the most significant drop in home values at 0.9 percent, while Canberra’s, Darwin’s and Adelaide’s dipped by 0.5 percent, 0.4 percent and 0.1 percent, respectively.

CoreLogic said the rise in home prices was most evident in the high-end segment of Sydney’s housing market, with a two percent growth following a sharp downturn in 2022.

“We may be seeing some opportunistic buyers returning to the market where prices have fallen the most.”

Regional housing markets also saw some improvements, with the combined regionals index increasing by 0.2 percent in March.

The most significant growth was observed in regional South Australia at one percent, while regional Tasmania reported the sharpest fall at 0.7 percent.

Meanwhile, the rental market remained extremely tight, with large capital cities expecting an acceleration in rental growth, especially in the unit sector.

Capital city house rents have jumped 24.8 percent since the COVID-19 outbreak in March 2020.

What Was Behind the Uptick in House Prices

Lawless attributed the first monthly rise in Australian home values to the tight rental market, the return of overseas migrants and a lack of new home listings.The research director believed the upward pressures from those factors were enough to counter the dampening impacts of high-interest rates and an economic slowdown.

“With rental markets this tight, it’s likely we are seeing some spillover from renting into purchasing, although, with mortgage rates so high, not everyone who wants to buy will be able to qualify for a loan,” Lawless said.

“Similarly, with net overseas migration at record levels and rising, there is a chance more permanent or long-term migrants who can afford to will skip the rental phase and fast track a home purchase simply because they can’t find rental accommodation.”

Lawless also noted that new home listings had trended down since September 2022, with capital city listing numbers ending March almost 20 percent below the previous five-year average.

Meanwhile, Nerida Conisbee, the chief economist at the real estate group Ray White–which uses a different home price index, said population growth and a housing shortage were the major factors driving up home values.

In addition, she said the rise in house prices was likely affected by market expectations that interest rates were likely to reach their peak.

“In places, we are seeing the strongest increases in rents, such as south-east Queensland, it is possible that price increases will hit double digits over the next 12 months.”

The chief economist also noted that so far, Australian house prices had dropped far less than what was generally predicted, just like what happened in every downturn.

“Housing markets almost always surprise with strength on the upside and see far less robust declines when the market turns,” Conisbee said.

“It is certainly the case for this cycle, with peak to trough decline of Australian capital city house prices of 6.5 percent, compared to COVID-19 driven price growth of 36 percent.”