TUCSON, Ariz.—Horses taught Christine Searle the importance of being fair. Intelligent and innately honest creatures, horses know deceit when they see it. She wishes that they could teach that principle to the state of Arizona.

The 70-year-old horse trainer and Arizona native is on the verge of losing her life savings over an unpaid $1,607.68 property tax bill.

“I owed them the money. And that’s what they should get—the money I owe them,” Ms. Searle told The Epoch Times.

“I don’t think that they should have the right to take all of it.”

Arizona is one of almost a dozen states that allow creditors to keep all of the proceeds from sales of foreclosed homes because of unpaid taxes—known as tax lien sales, according to the Pacific Legal Foundation (PLF).

“The taxpayer must render to Caesar what is Caesar’s, but no more,” Chief Justice John Roberts wrote in the unanimous decision.

But under current laws, 10 states and the District of Columbia have no means of returning the excess proceeds of a home sale. Those states include Alabama, Arizona, Colorado, Illinois, Massachusetts, Minnesota, New Jersey, New York, Oregon, and South Dakota.

Lawyers of the Mountain States Legal Foundation representing Ms. Searle call this “home equity theft.” Ms. Searle hopes that her case will be the one to set things right in Arizona.

In Arizona, a county treasurer can place a lien on a property for taxes owed. These financial claims are then sold at an online auction. In the auction, buyers bid the lowest interest rate that they intend to charge property owners to redeem their lien. The bidding begins at 16 percent, and the lowest bid wins.

Purchasing a tax lien doesn’t transfer ownership of the property. In Arizona, the property owner has three years to pay the back taxes, along with fees and interest. If it is not redeemed within that time period, the lienholder may foreclose and sell the property.

Unsold tax liens are turned over to the state. The state has the same right to foreclose but must return any excess proceeds to the former property owner.

In 2005, Ms. Searle bought a three-bedroom, two-bath house as a rental property for $255,000. The house is in Gilbert, Arizona, 22 miles southeast of Phoenix. Its 2024 property tax appraisal came to $376,800, but she stands to lose much more than the taxable value.

Various real estate websites estimate the current market value of the property to sit somewhere between $420,000 and $510,000.

The investment firm Arapaho LLC Tesco purchased the tax lien on Ms. Searle’s property when it bought all of Maricopa County’s 2015 and 2016 tax liens. The firm stands to gain a significant profit if it sells the property under current law.

Arapaho’s contact information was not available. An internet search showed that the Phoenix-based company—which is involved in a number of legal actions in Arizona—lists Hamilton Municipal Financing of Altamonte Springs, Florida, as a principal. Hamilton is incorporated in Delaware.

According to PLF, tax liens are popular with banks, investment firms, and other financial institutions because they are seen as relatively secure investments.

Retirement Plan Upended

On a dusty ranch near Tucson, Ms. Searle sits on a metal patio chair under a shady tree in front of some stables and talks about her retirement plan.“I have all my money invested in that home as my retirement instead of putting it in a [certificate of deposit] or some kind of a bank account. I can make a little money on the side to pay the mortgage and keep, and sell [the home] when I need the money,” she said.

Ms. Searle is shocked at how close she is to losing her life savings to an investment firm.

For 18 years, she lived in Chandler, Arizona, with her then-husband and her son, Randy Searle. According to Ms. Searle, she led a typically comfortable, suburban middle-class American life. Her husband worked for a jewelry and memorabilia company serving high schools and colleges, and she trained horses.

Ms. Searle knew it was possible to lose property over unpaid taxes. But that happened to other people. It wasn’t part of her life or something that she really knew very much about.

“I didn’t think about it,” Ms. Searle said.

Then came the divorce, and she had to consider many things to which she had never given much thought.

Ms. Searle had to find a way to support herself. Her son was grown, so she could afford a simpler lifestyle. Ms. Searle took her divorce settlement and purchased the house in Gilbert to use as a rental to supplement her income.

Ms. Searle’s work goes beyond teaching horses to respond to commands. Many horse owners live and work far from the stables in Tucson, so she is the horses’ primary caregiver. Ms. Searle is responsible for feeding and exercising the animals and for arranging veterinary care and farrier services for them.

“I don’t have a nine-to-five job; I have a 24-hour job. Whenever there’s something wrong, I come down here and work on it, take care of it,” she said. “I’m doing it just because I enjoy it. ... It’s not like anyone’s making a lot of money here.”

Ms. Searle’s son blames himself for his mother’s predicament.

Mr. Searle, as the tenant at the Gilbert house, said it was his job to manage the property. At the same time, he was trying to get a solar energy company in Rhode Island off the ground.

“I had been responsible for paying [the property taxes], and when our company went out of business in Rhode Island, I didn’t have the money to pay them,” Mr. Searle told The Epoch Times.

He said he had worked out a plan with Arapaho to redeem the 2016 lien. However, because of a miscommunication, Mr. Searle didn’t realize that foreclosure proceedings had been initiated over the 2015 taxes.

Soon, he received an eviction notice from Arapaho and American Pride Properties LLC, which had obtained the lien from Arapaho.

He noted that the lienholder, not the county, decides whether to foreclose.

The Buffer Zone

More than 2,600 miles away, in Bolton, Massachusetts, Alan DiPietro is faced with a property tax problem that his lawyer describes as a Catch-22 created by the town.“The story behind this case, I think, would give Franz Kafka nightmares,” PLF attorney Joshua Polk told The Epoch Times.

Mr. DiPietro sued the town of Bolton, claiming that it is using state law to stymie his attempts to pay his property taxes so that it can take his land.

“If the town had simply allowed Mr. DiPietro to pay his taxes, they would have their money, and he would have his property,” Mr. Polk said.

“But it seems like they’re more interested in retaining this property than they were in actually getting the money that they were owed.”

On June 20, 2014, Mr. DiPietro paid $160,000 for 34 acres on a wooded hillside with a small pond and a ditch. The property straddles county lines, with 28 acres in Bolton, Worcester County, and six acres in Stow, Middlesex County.

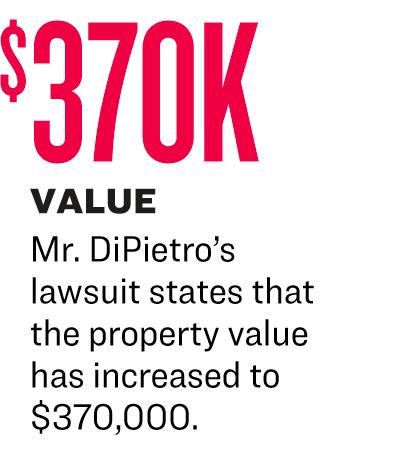

Mr. DiPietro’s lawsuit states that the property value has increased to $370,000.

In 2021, the town of Bolton confiscated the property over a debt of $60,000 owed in back taxes.

“This lawsuit alleges that Bolton ... violated the U.S. and Massachusetts constitutions and unjustly enriched itself when it took Mr. DiPietro’s Property without paying him just compensation,” the lawsuit reads.

Mr. DiPietro is an affable man who tells his story with more astonishment than anger. He is incredulous at the roadblocks he says town officials have thrown up to prevent him from paying his taxes.

“It gets ridiculous when they say, ‘Yeah, we took your land. We took your equity. But we didn’t do anything wrong because you can sue us and get it back if you want,’” Mr. DiPietro told The Epoch Times.

“Well, you didn’t have the money to pay your taxes, and you didn’t have the money to hire a lawyer. Where are you going to get a half-million dollars to sue them in federal court?”

Mr. DiPietro, a mechanical engineer, worked with the team that designed a popular robot vacuum. He grew weary of corporate bureaucracies and micromanagement and decided to make a change.

At the time, Mr. DiPietro had a small alpaca herd that had outgrown his property in Maynard, Massachusetts. He said the property in Bolton was perfect. Mr. DiPietro knew it would take a huge effort to get the property in shape. He didn’t realize all that his future held.

“This piece, when I was growing up, was an old farm that hadn’t been farmed, so it was getting overgrown. I figured there was going to be some problems with it. But I had no idea,” Mr. DiPietro said.

Shortly after buying the land, he and his wife separated and eventually divorced.

Mr. DiPietro’s lawsuit describes the divorce as “financially devastating,” ending in bankruptcy.

But he had a 401(k) plan that he was able to invest in his fledgling alpaca farm.

Mr. DiPietro planned to build a house for his parents and one for himself on the southernmost parcel, at 110 Teele Road in Bolton. He started the permit application process for the houses and set to work making a home for his alpacas. This included building what is described in court documents as “rustic wooden fencing.”

The fence runs northeast along the property’s frontage with Teele Road and is made from branches cut from trees on the property. Thin barbless wire, similar to that used for horse pens, runs through the fence. Mr. DiPietro built sheds and other structures that he would need to care for the alpacas.

Then, he mowed his grass to make it easier for the alpacas to graze.

“That’s when the towns decided that I was the worst threat to the environment they’ve ever seen,” Mr. DiPietro said.

The Stow and Bolton conservation commissions notified him that he may have violated the Massachusetts Wetland Protection Act. He was ordered to explain how his work complied with the act, or else return the land to its original condition.

Mr. DiPietro said he learned that wetlands require a “buffer zone” in which no work can be done. The pond and ditch on his property were classified as wetlands, as were other parts of the property. The resulting buffer zones made it impossible to use any part of the property.

“They’re talking about buffer zone on top of buffer zone next to a vegetated wetland, which itself is a buffer zone because it’s not actually a wetland,” Mr. DiPietro said. “They’ve bloated that definition of wetlands so out of proportion it’s utterly ridiculous.”

The towns sued Mr. DiPietro, and the subsequent legal bills further depleted his financial resources. He was now unable to pay his property taxes.

Mr. DiPietro tried growing industrial hemp to raise money to pay the taxes. But his crops were stolen. Mr. DiPietro then tried to cut and sell timber, but that brought up more environmental concerns.

According to his lawsuit, he found emails in which town officials instructed local postmasters to stop delivering his mail. His mailbox on Teele Road has the number 110 painted on it, and Mr. DiPietro said he had received mail there.

But, mysteriously, he said, his mail delivery stopped at about the same time that the towns sued him.

Mr. DiPietro said the emails revealed that the Bolton town clerk had instructed the postmaster to stop deliveries to his Teele Road mailbox because the city didn’t issue the address.

He said he had already lost the wetlands case by the time that he realized the mail had stopped.

“When I went down to find it had been stopped, I'd already missed correspondence from the court. I was defaulted. They won the case on the wetlands because I never even got to present anything,” Mr. DiPietro said.

He and his lawyer believe that the town has a strong motive for hindering his efforts to pay his taxes.

“Bolton has a financial incentive to foreclose and then keep or sell valuable properties, like the property in this case, rather than help owners avoid foreclosure,” the lawsuit reads.

Property values in the area have increased considerably in the past 10 years, according to an interactive map at Homes.com.

The website lists undeveloped land near Mr. DiPietro’s property with an estimated market value of between $140,000 and $230,000 per acre. Single-family homes in the area have recently sold within days of being listed, the website shows. Most were sold in the range of $500,000 to $1 million.

A two-bedroom, two-bath, 904-square-foot home on less than a half-acre within sight of Mr. DiPietro’s property was recently listed for $426,153.

So, with $370,000 invested in the property and facing a $60,000 tax bill, Mr. DiPietro decided to stop fighting and just sell the lot to pay the taxes. He expected to make about $200,000 on the sale, which would more than cover his bill.

But the town complicated that as well, Mr. DiPietro claims.

He hadn’t received the permits that he'd applied for, so no one would buy the property. Local authorities wouldn’t grant the permits because he had unpaid taxes. Mr. DiPietro said there’s evidence that the towns took an active role in blocking the sale.

Mr. Polk said the emails that they’ve found show that town officials reportedly discouraged potential buyers. He believes the town is more interested in reaping a windfall than collecting taxes.

“While the town didn’t directly say no sale would be possible, they did say this is a complicated situation and to be wary. And so those buyers were essentially scared off,” Mr. Polk said.

The town offered a payment plan in which Mr. DiPietro would pay an initial $100,000, followed by monthly payments. But the plan had no guarantees.

“And so, for a $200,000 lot, they’re already telling me, ‘You’ve got to come up with $100,000 upfront to find out whether the town’s going to give you the permits or not,’” Mr. DiPietro said.

Mr. Polk said state and local officials are aware of the 2023 Supreme Court decision that ruled their practices unconstitutional. But that decision hasn’t had much impact in Massachusetts.

Officials in Arizona and Massachusetts contacted by The Epoch Times would not comment on the record for this story.

Bolton Town Clerk Michelle Carlisle wrote in an email to The Epoch Times that she could not comment on active litigation. She directed the reporter to look up Massachusetts’s state law.

No Way to Give Back

Mr. Polk said the Supreme Court decision creates a problem for states such as Arizona and Massachusetts.In Tyler v. Hennepin County, Minnesota, the high court ruled that keeping more than the taxes due, after a tax sale, is illegal under the Fifth Amendment.

The Supreme Court has used the same reasoning in subsequent decisions.

The court released unsigned, unanimous orders on June 5, 2023, summarily reversing two rulings by the Nebraska Supreme Court.

The Nebraska cases were remanded back to the state Supreme Court “for further consideration in light” of the Tyler ruling.

Mr. Polk said it is incumbent upon state legislatures to write legislation necessary to comply with Tyler, but said that that is almost impossible in Massachusetts.

“The way that Massachusetts has responded, or not responded, to the Tyler case has put municipalities in a difficult situation because existing law doesn’t provide a mechanism by which towns can return excess funds to the original owner,” he said.

But that doesn’t mean that everyone is turning a deaf ear.

Massachusetts Attorney General Andrea Joy Campbell issued guidelines for government officials and property owners as to how to proceed in the wake of the Supreme Court decision. According to the guidelines, the state’s law is unconstitutional, and no government entity should take any more than the taxes that are due.

“Failure to observe this principle could result in liability for an unconstitutional taking,” the guidelines read.

Ms. Campbell didn’t respond to a request for comment on this story.

The three-paragraph bill states, “Notwithstanding paragraph (a), a taxpayer or his heirs shall be entitled to the surplus from any sale of the property after the deduction of all costs, charges or expenses, taxes and interest owed.”

Ms. Creem didn’t respond to requests for comment.

The state House passed the bill at the end of February, and it’s currently in the Senate.

Everyone Must Pay

Ms. Searle and Mr. DiPietro accept the fact that they must pay taxes.“I don’t want to pay for the new school, but all right, I'll concede that maybe I owe it,“ Mr. DiPietro said. ”But you don’t get to take 10 times as much just because I couldn’t pay on time.”

PLF attorney Christina Martin said Tyler v. Hennepin County, Minnesota, which she argued, and the Nebraska orders are a preview for states that engage in “home equity theft.”

“These states should be on notice: Change your laws or face millions of dollars in damages in court,” Ms. Martin wrote in a statement provided to The Epoch Times.

Mountain States Legal Foundation counsel William Trachman calls his client an unlikely hero. Ms. Searle doesn’t see herself that way.

She said she has been backed into a corner with nothing left to lose. If she prevails, she will get what is hers, and if she fails, she’s no worse off. The principle is worth the fight, Ms. Searle said.

“I think that people have to have the courage to do what’s right and stand up for what’s right,” she said. “A law that’s wrong, [you] just say, ‘OK, fine,’ and walk away?

“Can’t do that.”