LONDON—On his 10-year trip home, the Greek hero Odysseus at one point had to steer his ship and crew between Scylla, a six-headed monster, on one side of a narrow stretch of water and the whirlpool Charybdis on the other.

The Greek people are in similar dire straits as they prepare to vote on a future in which they face two painful prospects: the slow grind of years more of austerity cuts or the country’s potentially catastrophic exit from the euro.

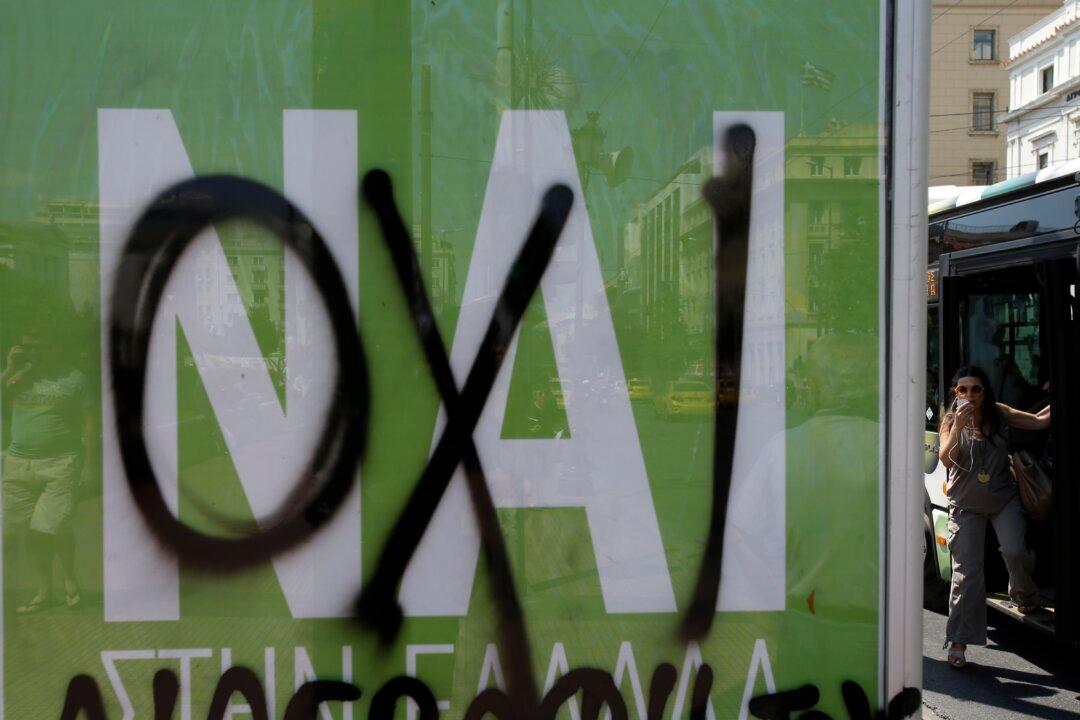

The question is whether their vote on Sunday can help them escape either. “Yes” to the proposal for more budget cuts in exchange for a financial aid package for the country? Or reject it in the hope it will not lead the country out of the euro?