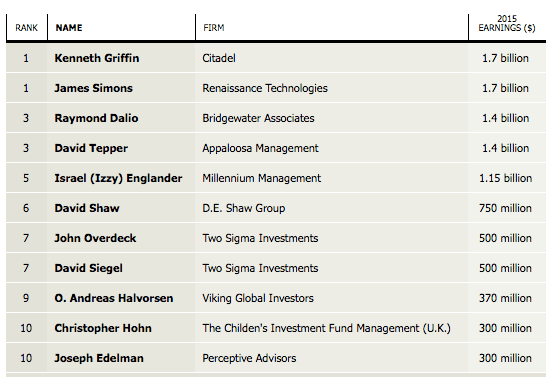

The top 25 hedge fund managers earned nearly $13 billion in 2015, according to Institutional Investor’s Alpha magazine. Both Kenneth Griffin of Citadel and James Simons of Renaissance Technologies topped the list, each making a whopping $1.7 billion last year.

The magazine publishes the top 25 highest-earning hedge fund managers list annually. The incomes are estimated based on the share each manager earns from the fees charged to the clients as well as the gains on the capital he has personally invested in his funds.

The combined earnings are up about 11 percent from the previous year. However, they are down substantially from the record $25.3 billion earned in 2009, just after the financial crisis.

Institutional Investor's Alpha magazine