Stock indexes around the world rose Monday after G-20 finance ministers promised to avoid a currency war. The dollar fell and attention turned toward the U.S. Federal Reserve’s anticipated injection of cash into the economy, which may further weaken the dollar, the Associated Press (AP) reported.

G-20 finance ministers will announce their plans to help the global economic recovery at next month’s meetings in South Korea, but for now, they said they would avoid competitive devaluation—weakening national currencies to help exports, which can increase income from foreign markets.

“The agreement the finance ministers reached is being interpreted by the market as a go-ahead to the U.S. to further devalue the dollar, that the developing countries won’t partake in a competitive currency devaluation,” said Victor Shum, an energy analyst with Pervin & Gertz in Singapore, according to the AP report.

“It’s a signal to the market that some more weakening of the U.S. dollar will probably be tolerated by everybody else.”

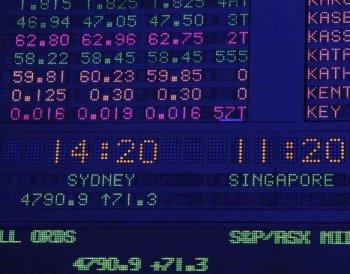

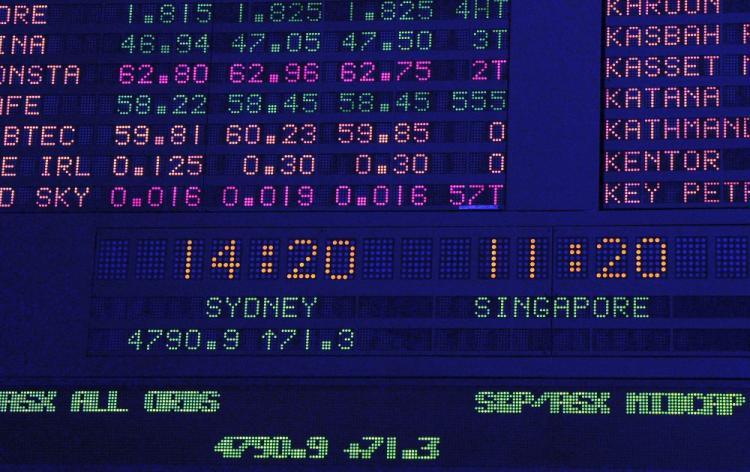

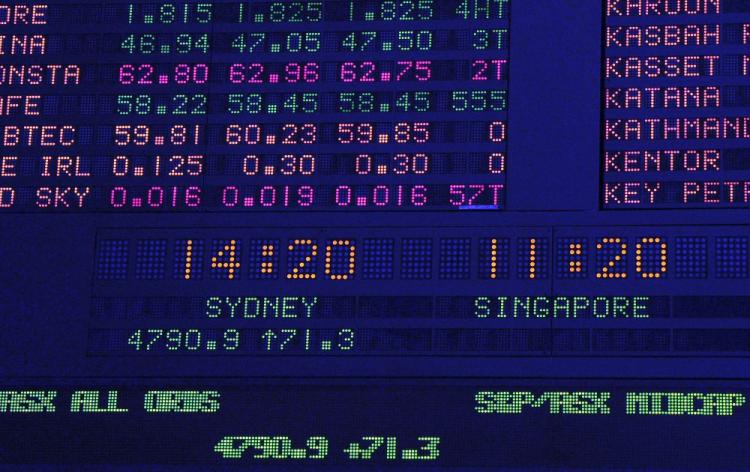

Based on this news, stock markets in Europe and Asia mostly responded with increased value.

Britain’s FTSE 100 rose .65 percent, France’s CAC 40 rose .5 percent, Germany’s DAX was up .7 percent, Hong Kong’s Hang Seng was up .5 percent, and Standard & Poor’s ASX 200 rose 1.33 percent, according to Bloomberg.

Only Japan’s Nikkei index dropped, by .3 percent, as the U.S. dollar traded at a 15-year low compared to the Japanese yen, AP reported. The dollar was worth 80.52 yen Monday, down from 81.50 on Friday, while it also dropped versus the euro, which rose from $1.39 to $1.40.

Other Asian indexes rose. Korea’s KOSPI was up 1.21 percent, and China’s Shanghai Stock Exchange rose 2.57 percent, USA Today, reported.

G-20 finance ministers will announce their plans to help the global economic recovery at next month’s meetings in South Korea, but for now, they said they would avoid competitive devaluation—weakening national currencies to help exports, which can increase income from foreign markets.

“The agreement the finance ministers reached is being interpreted by the market as a go-ahead to the U.S. to further devalue the dollar, that the developing countries won’t partake in a competitive currency devaluation,” said Victor Shum, an energy analyst with Pervin & Gertz in Singapore, according to the AP report.

“It’s a signal to the market that some more weakening of the U.S. dollar will probably be tolerated by everybody else.”

Based on this news, stock markets in Europe and Asia mostly responded with increased value.

Britain’s FTSE 100 rose .65 percent, France’s CAC 40 rose .5 percent, Germany’s DAX was up .7 percent, Hong Kong’s Hang Seng was up .5 percent, and Standard & Poor’s ASX 200 rose 1.33 percent, according to Bloomberg.

Only Japan’s Nikkei index dropped, by .3 percent, as the U.S. dollar traded at a 15-year low compared to the Japanese yen, AP reported. The dollar was worth 80.52 yen Monday, down from 81.50 on Friday, while it also dropped versus the euro, which rose from $1.39 to $1.40.

Other Asian indexes rose. Korea’s KOSPI was up 1.21 percent, and China’s Shanghai Stock Exchange rose 2.57 percent, USA Today, reported.