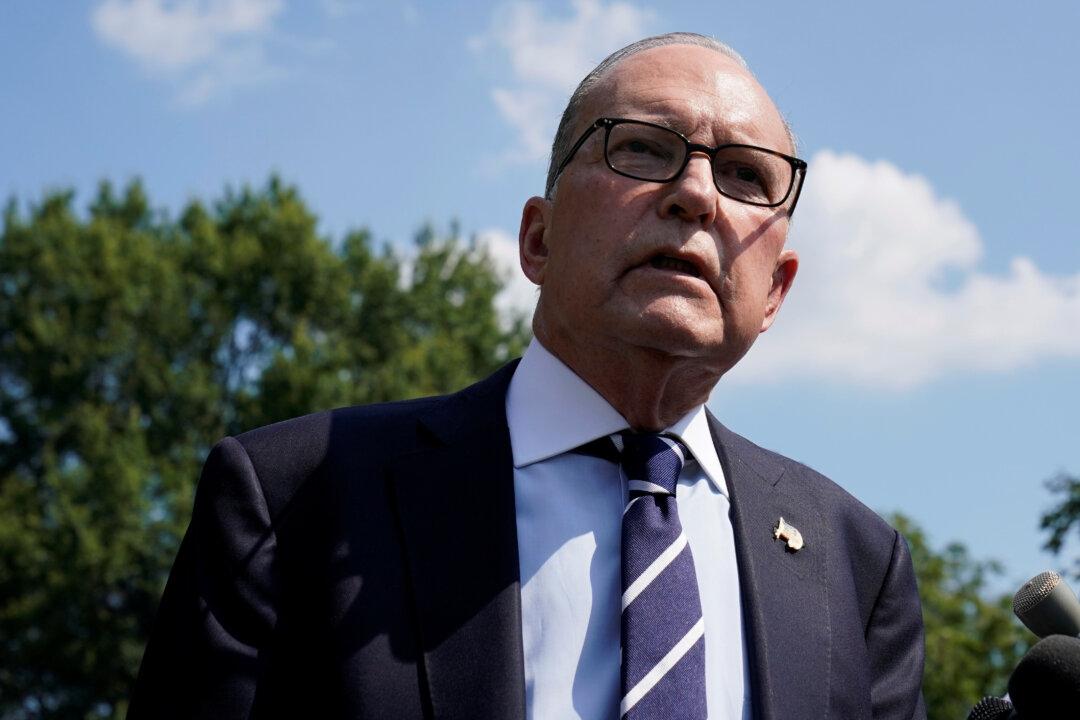

National Economic Council Director Larry Kudlow says he “wouldn’t mind” seeing a return to a 15 percent capital-gains tax rate, while noting that President Donald Trump wouldn’t seek such a cut through an executive order.

“We are looking at middle-class income tax cuts and capital gains tax cuts to spur investment and jobs and liquidity,” Kudlow told reporters at the White House on Aug. 12