The White House said Sunday that 2.2 million small business loans worth $175 billion were doled out in the second round of the Small Business Administration’s Payroll Protection Program (PPP).

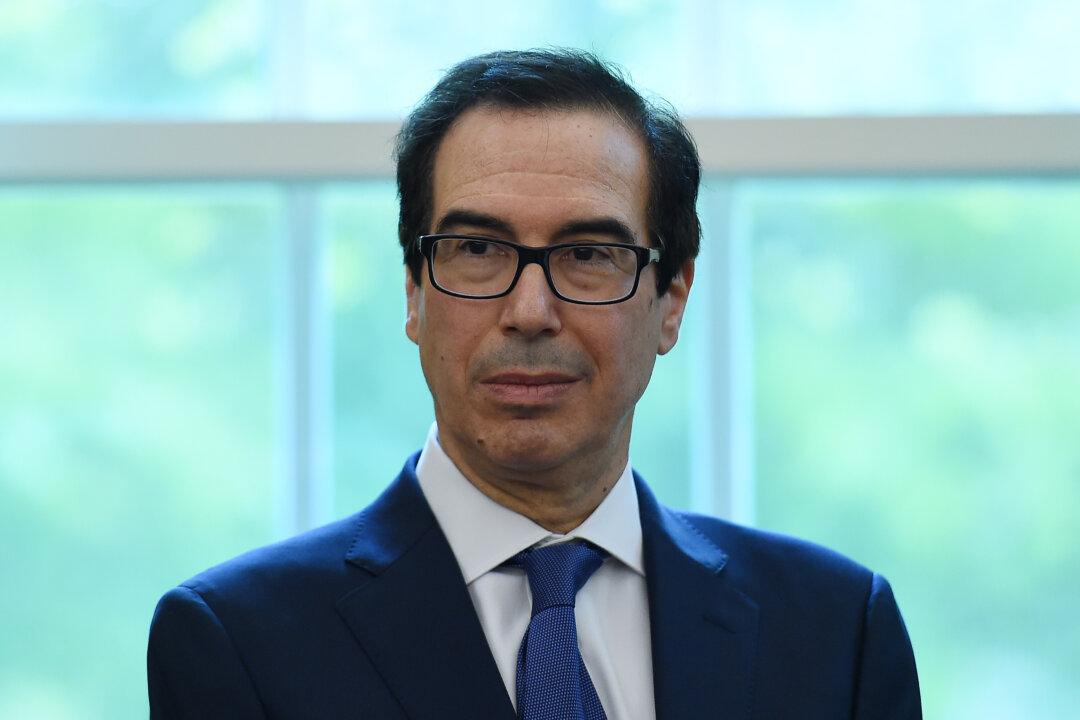

Treasury Secretary Steven Mnuchin and Small Business Administration Administrator Jovita Carranza said the average size of the loan was about $79,000. The agency started sending out its second round of payments on April 27, coming days after Congress passed a measure to infuse it with funds.