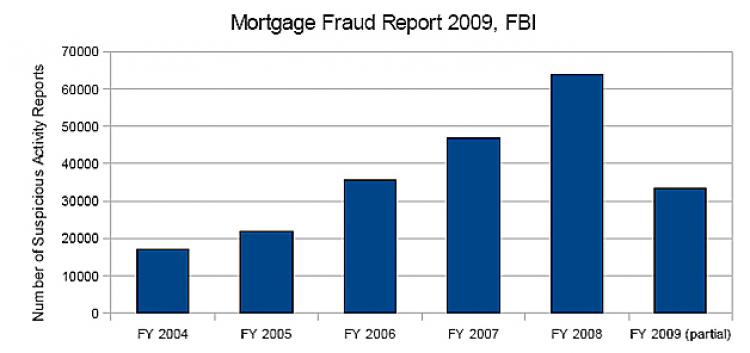

Suspicious activity reports topped 63,173 in the 2008 fiscal year (FY), which ended in September. This is a 36 percent increase on the previous year of 46,717 reports.

This fiscal year is proving to be busy for the fraud office, with 40,901 suspicious activity reports listed up to the end of April. The projection is that more than 70,000 will be filed by fiscal year end.

Actual cases that opened in fiscal year 2009 (through 4/30/09) were 965, compared to 136 in all of fiscal year 2004.

“Mortgage fraud hurts borrowers, financial institutions, and legitimate homeowners,” Assistant Director Kevin Perkins, from the FBI Criminal Investigative Division, said in the report. “The FBI, in conjunction with our law enforcement, regulatory, and industry partners, continues to diligently pursue perpetrators of mortgage fraud schemes.”

Conditions Ripe for Fraud

The mix of factors in the financial world has “uncovered and fueled a rampant mortgage fraud climate, fraught with opportunistic participants desperate to maintain or increase their current standard of living,” the FBI report said.

“Industry employees sought to maintain the high standard of living they enjoyed during the boom years of the real estate market, and overextended mortgage holders were often desperate to reduce or eliminate their bloated mortgage payments.”

The top mortgage fraud states for 2008 were California, Florida, Georgia, Illinois, Michigan, Arizona, Texas, Maryland, Missouri, New Jersey, New York, Ohio, Colorado, Nevada, Minnesota, Rhode Island, the District of Columbia, Massachusetts, Pennsylvania, and Virginia.

According to the Mortgage Bankers Association, as of March 2009, 5.4 million American homeowners holding a mortgage, nearly 12 percent of American homeowners, were at least one month behind in their payment or in foreclosure at the end of 2008.

There were more than 3.1 million foreclosure filings reported nationwide during 2008, according to RealtyTrac, Inc., an 81 percent increase in total properties from 2007 and a 225 percent increase in total properties from 2006.

FBI’s Outlook

The depressed economy witnessed during 2008 is generally expected to persist, at least through the end of 2009, and possibly longer, and it will continue to provide a favorable environment for expanded mortgage fraud activity. Industry personnel will feel pressure to find alternative methods to match the income they enjoyed during the real estate boom years. Many will be willing to conduct criminal activities to achieve this goal. Increasing numbers of individuals will be willing to consider and participate in illicit deals to avoid foreclosure.

Perpetrators may focus their fraud efforts on new targets that have been created as the result of actions to combat the mortgage fraud crisis. Persons looking to purchase foreclosed properties on the market may be potential victims of additional scams. Perpetrators may find methods to exploit funds earmarked for the mortgage industry from the various legislative acts aimed at addressing the mortgage and financial industry crisis and stimulate the economy. As loan originators and borrowers increase their use of FHA-backed mortgages, following the collapse of the sub-prime mortgage market, perpetrators are likely to follow this money trail as well.

Key Findings

* Sixty-three percent (1,035) of all pending FBI mortgage fraud investigations during FY 2008 involved dollar losses totaling more than $1 million.

* More than 3.1 million foreclosure filings were reported on approximately 2.3 million properties nationally during FY 2008, up 81 percent from FY 2007 and 225 percent from FY 2006.

* As of FY 2008, the western region of the United States had the most pending FBI mortgage fraud-related investigations.

* The top 10 mortgage fraud states for 2008 were California, Illinois, Texas, Georgia, Ohio, Colorado, Maryland, Florida, Missouri, and New York.

* Rhode Island, Massachusetts, Pennsylvania, and the District of Columbia were newly identified as having significant mortgage fraud problems.

* Criminals continued using old schemes, including property flipping, builder-bailouts, short sales, and foreclosure rescues. Additionally, in response to tighter lending practices, they facilitated new schemes, such as reverse mortgage fraud, credit enhancements, condo conversion, loan modifications, and pump and pay.