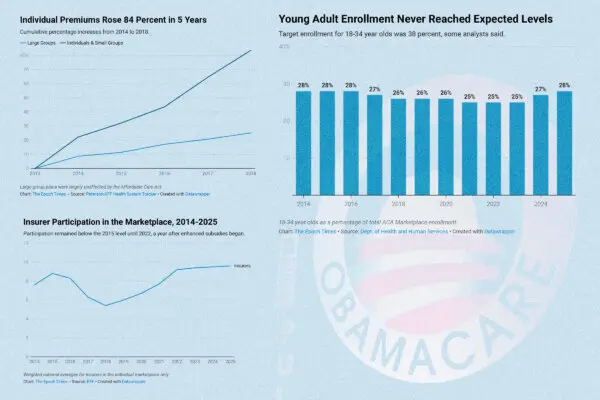

American health insurance seems to frustrate everyone. Patients complain that it’s expensive and complicated. Providers say it buries them in paperwork and can negatively affect patient care.

US Health Insurance: What Are Its Problems and Potential Solutions?

An overview of the chief complaints, root causes, and possible solutions to the U.S. health insurance dilemma.

Illustration by The Epoch Times, Freepik

US Health Insurance: What Are Its Problems and Potential Solutions?

An overview of the chief complaints, root causes, and possible solutions to the U.S. health insurance dilemma.

Save

More Premium Reports

see moreAD