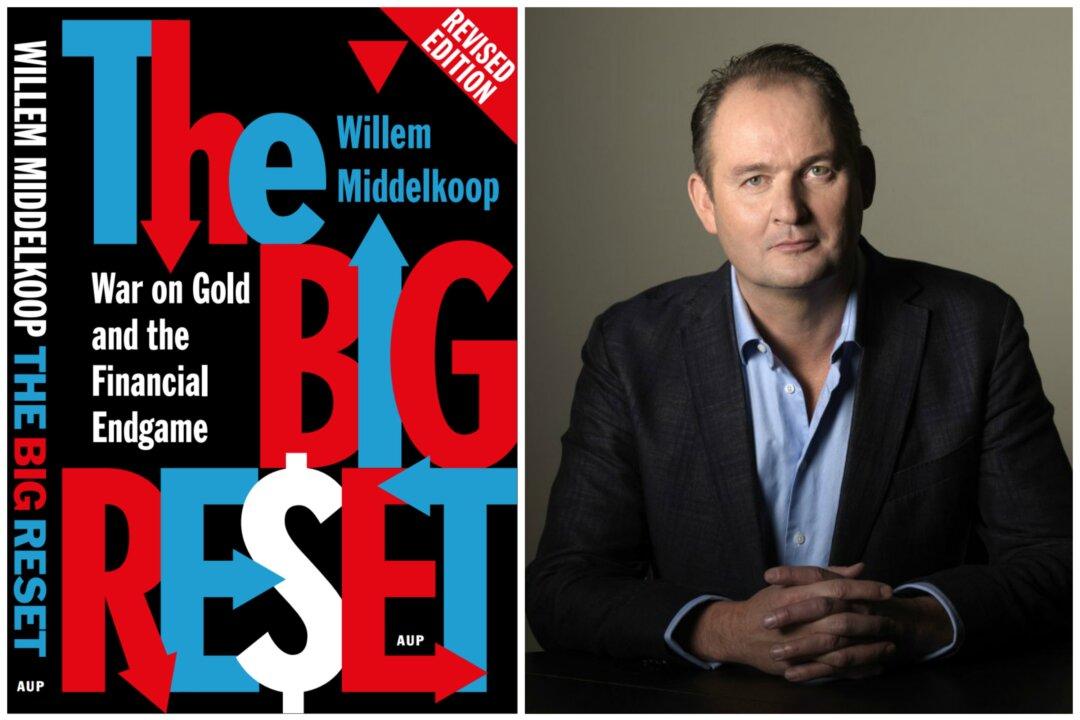

It was in the late 1990s when Willem Middelkoop finally figured it out. He came home from work one day and told his girlfriend: “I understand the financial system.”

This may seem ironic because Willem is not a banker, financier, or an economist. Or maybe not, because most mainstream economists and bankers have a horrible track record at predicting market movements or major shifts in the financial system.

Middelkoop was a photojournalist when he became curious about why he could buy eight properties in Amsterdam with no money down and rent them out straight away for an almost risk-free profit. So he began to ask questions.

It is my belief that, well before 2020, the global financial system will need to be rebooted to a new paradigm in which gold will play a larger role.