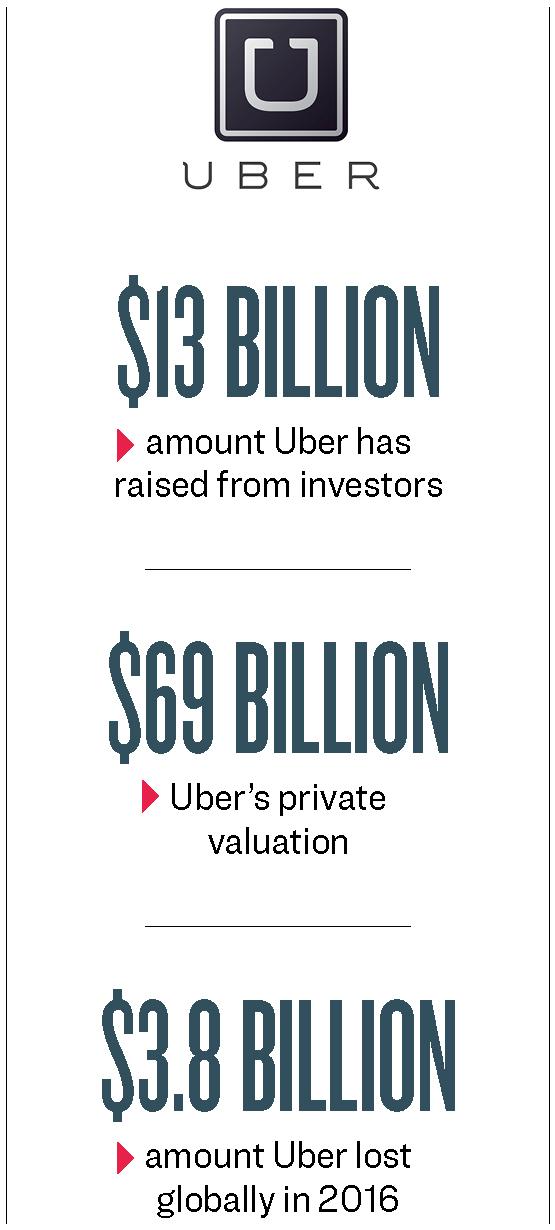

Uber is losing money faster than any other Silicon Valley startup. The ride-hailing company does not own cars or other fixed assets, but it is valued higher than both General Motors and Ford.

So what makes this cash-burning machine the most valuable private company in the world?

According to transportation industry expert Hubert Horan, Uber’s whopping valuation reflects the anticipation that it would one day drive all incumbent taxi and limo companies out of business.

“It is well on the way to achieving that objective in many markets,” Horan said, in a report.

*