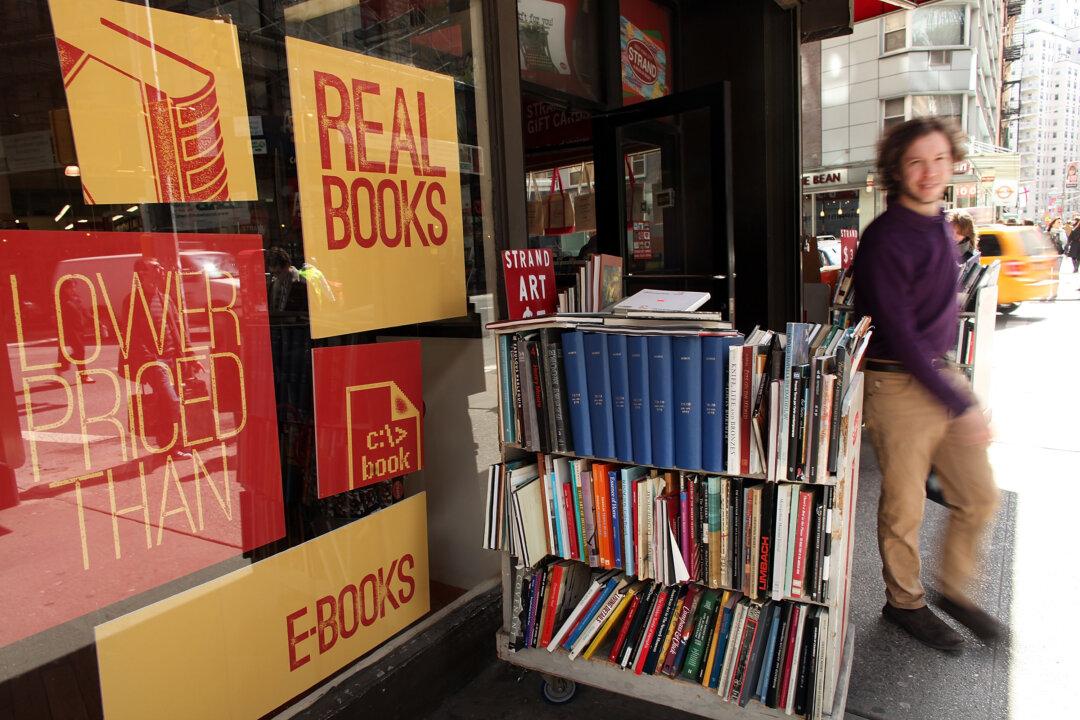

It’s no secret that independent bookstores are faring poorly. In England, their ranks have been thinned from 1,535 stores in 2005 to under a thousand just last year, a fall that many store owners attribute to the rise of e-sellers like Amazon.

One advantage that Amazon has over brick-and-mortar bookstores is that it doesn’t have to pay the overhead costs of renting out space and displaying the physical books.

Buyers can find what they’re looking for in the store and then buy it for a lower price online.

The practice, called showrooming, has been denounced by some authors as a form of theft. Now, a Chrome extension developer wants to turn the tables on Amazon and make the online bookstore a virtual showroom for its physical counterpart.

Once installed on Chrome, BookIndy overlays an additional buying option, “local bookstore,” on Amazon when you’re browsing for books that happen to be available from an independent bookstore nearby.

The extension works in collaboration with Hive, an independent online retailer, and hundreds of participating independent bookstores—for now, the app only works in England. It’s even offering free delivery for standard shipping (3–5 days) or 3 pounds ($4.75) for express (1–2 days).

It’s not clear what infrastructure BookIndy relies on to offer free shipping, which Amazon only offers on orders that are $25 dollars or more. It’s likely that, like other startup services, delivery is being subsidized to maximize growth.

Will Cookson, the creator of the app, said that he was motivated to build BookIndy after ruminating about how his own book-buying patterns, which had largely migrated to online stores in recent years, revealed a profound laziness in himself.

“I slipped into the convenience trap. I happily ordered my Ballards, my Murakamis, my Carvers from Amazon without giving much thought to my local independent bookshop, just 10 minutes from my home,” Cookson wrote on Medium. “I think we do care about local independent shops but we’ve turned into lazy, laptop-in-bed, impulse purchase type people, who crave convenience.”