Even Wall Street didn’t figure out that China hit a bit of a rough patch until early 2016. But some of the brightest minds in finance have had their eyes on China for a long time, betted against it, and are starting to profit.

1. John Burbank, Passport Capital

Most of the hedge funds betting against China see the currency as the ultimate proxy for the economy. John Burbank thinks it could drop by 15 percent and that the effects on the world financial system would be similar to what happened after September 11, 2001.

“They can’t curtail money going out of the country. A 15 percent drop in the currency could be the equivalent of what happened to markets after September 11th,” he said in an interview with Bloomberg.

2. Mark Hart, Corriente Capital

One of the lesser known but very successful fund managers is Mark Hart. Based in Texas, he correctly predicted the subprime crisis as well as the European financial crisis and has been predicting a credit collapse in China since 2010.

“Extreme credit growth usually leads to a credit bust,” he said in an interview with RealVisionTV. He thinks the Chinese currency will drop 50 percent in value this year.

3. Kyle Bass, Hayman Capital

Mark Hart’s fellow Texan Kyle Bass also predicted subprime and has the same opinion on China. He goes into more detail about why the banking system will be the epicenter of a credit meltdown and a collapse in the currency.

“In China, in dollar terms their banking system is almost $35 trillion against a GDP of $10 trillion and their banking system has grown 400 percent in 8 years with non-performing loans being nonexistent. So what we are going to see next is a credit cycle, and in a credit cycle you see some losses. But if China’s banking system loses 10 percent, you are going to see them lose $3.5 trillion,” he told CNBC.

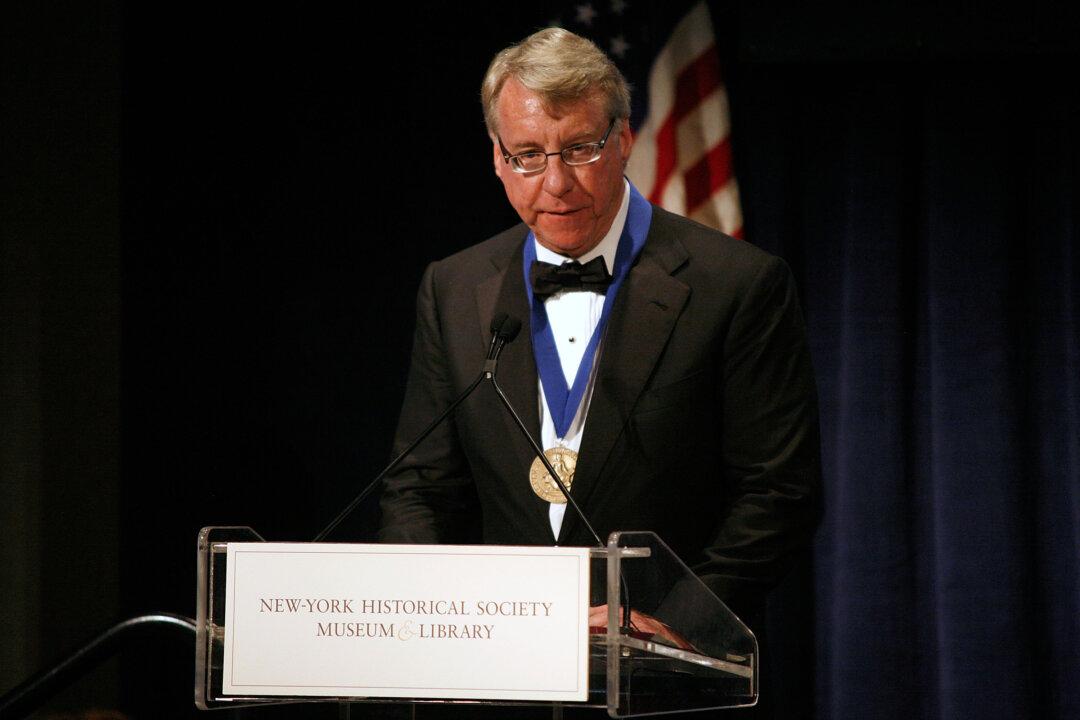

4. James Chanos, Kynikos Associates

For many, James Chanos is the original China bear who first spotted this opportunity in 2009. He says China’s growth wasn’t a miracle and the United State could have done the same: “If [the U.S. economy] was growing its credit by 30 or 40 percent per year, we'd be growing high single digits ourselves,” he said, discrediting the view China’s historic growth has been an economic miracle: “There is not a lot of magic here if you can borrow the money.”

5. George Soros

Although billionaire investor George Soros did not mention China specifically when he said he was shorting Asian currencies, Chinese state media felt offended and wrote a scathing op-ed called: “Declaring War on China’s Currency? Ha Ha” trying to scare Soros and other speculators.

And all he said that a hard landing of the Chinese economy was unavoidable.