The US Economy in a Nutshell

U.S. economic activity no longer appears to be contracting and is showing small improvements in the 12 Federal Reserve Districts.

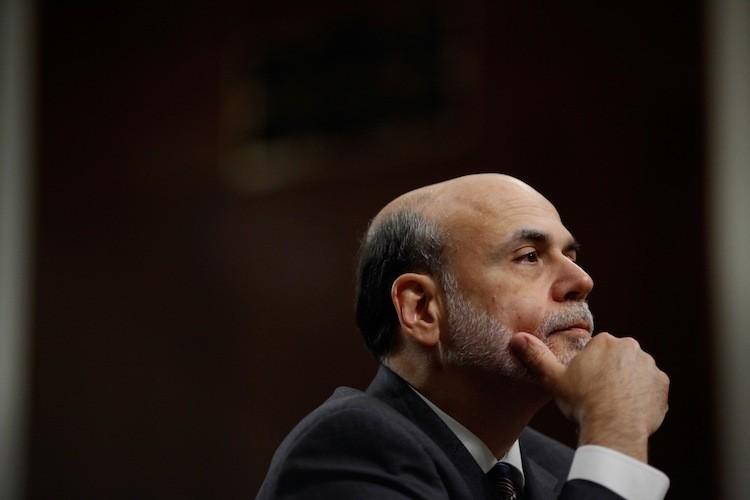

Federal Reserve Chairman Ben Bernanke testifies before the U.S. Congress Joint Economic Committee in the Dirksen Senate Office Building on Capitol Hill last month in Washington. Bernanke commented recently that the economic recovery has been weaker than anticipated. Chip Somodevilla/Getty Images

|Updated: