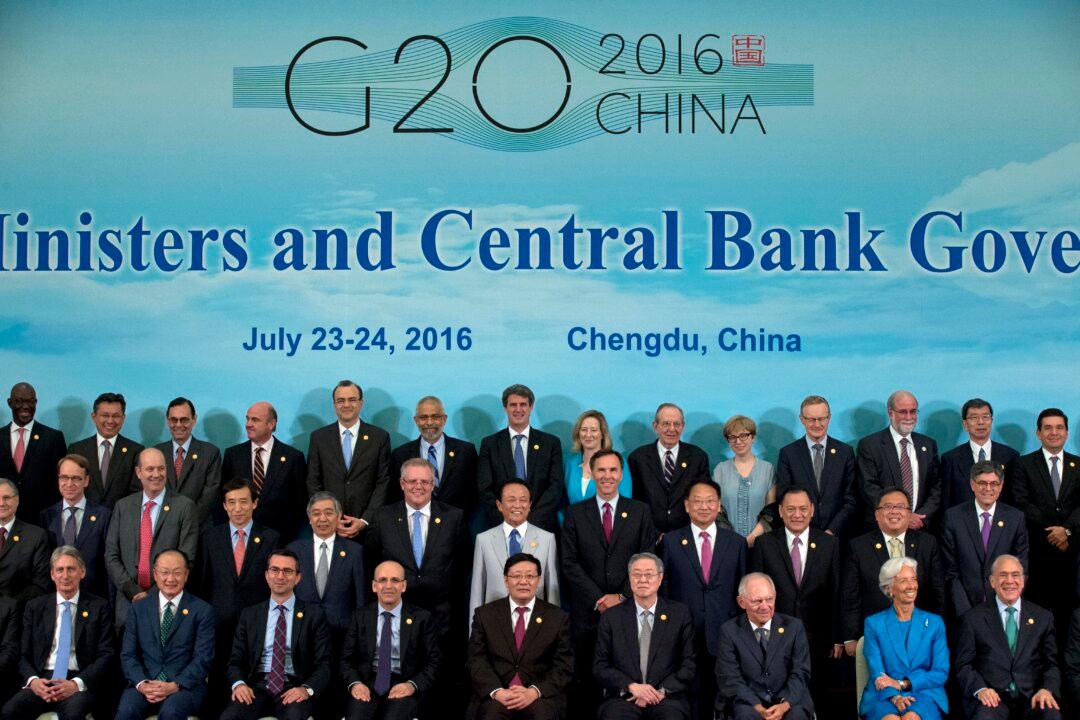

The G-20 summit in China came and went with the usual pompous statements at the end:

“The communiqué reiterates the essential role of structural reforms in boosting productivity and output, as well as in promoting growth in G-20 countries. The choice and design of structural reforms are consistent with countries’ specific economic conditions,” the People’s Daily sums up one of the points on the agenda.

The other points where the G-20 reached some kind of consensus were trade, anti-corruption, financial reform, investment, industrialization, entrepreneurship, climate change, innovative growth, and development.

READ MORE