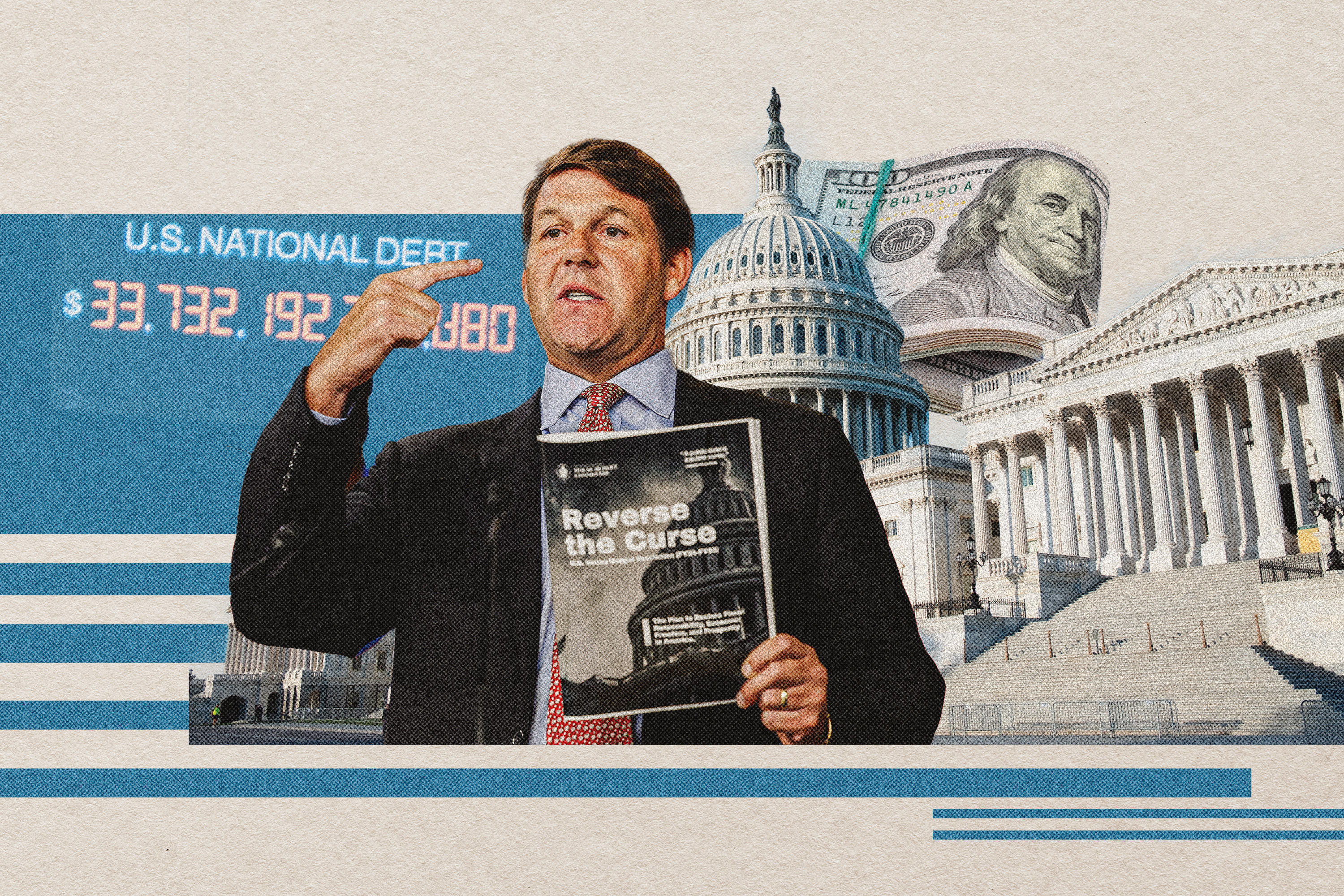

Rep. Jodey Arrington grew up in West Texas where there is nothing but miles and miles of nothing but miles and miles. When voters elected him to represent them in Washington in 2016, they sent him to a place where there is nothing but deficit spending and debt.

Six years later, Mr. Arrington is chairman of the House Budget Committee. He has made it his mission to find a way to bring Democrats and Republicans together to find a cure for their addiction to spending federal tax dollars and digging the nation deeper into debt.