This year will be the third consecutive year of supply shortage in the global coffee market, according to the International Coffee Organization (ICO).

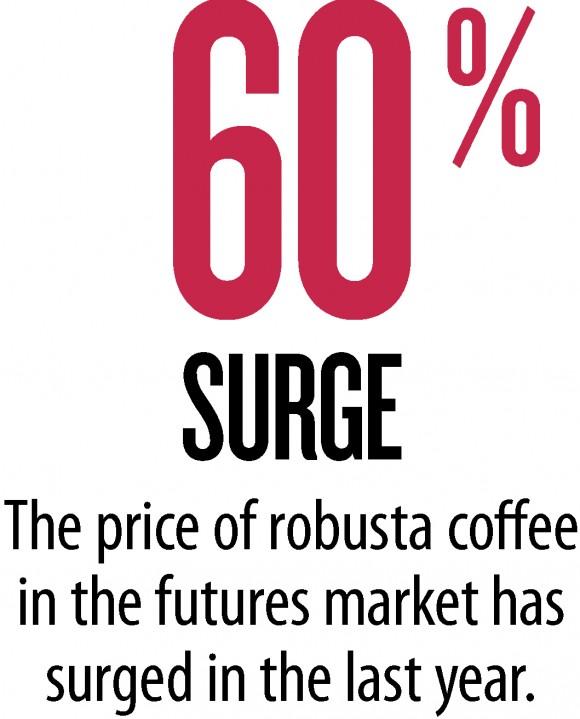

Due to a poor global harvest of robusta beans, coffee prices are rising. Bad weather caused by El Niño hurt robusta bean production by the world’s top two producers, Brazil and Vietnam.

“Both countries had a very poor robusta coffee crop last year due to drought,” said Shawn Hackett, CEO of Hackett Financial Advisors, a commodity broker.

And recently, excessive rainfall in Vietnam disrupted the harvest of this year’s crop, he said.

*