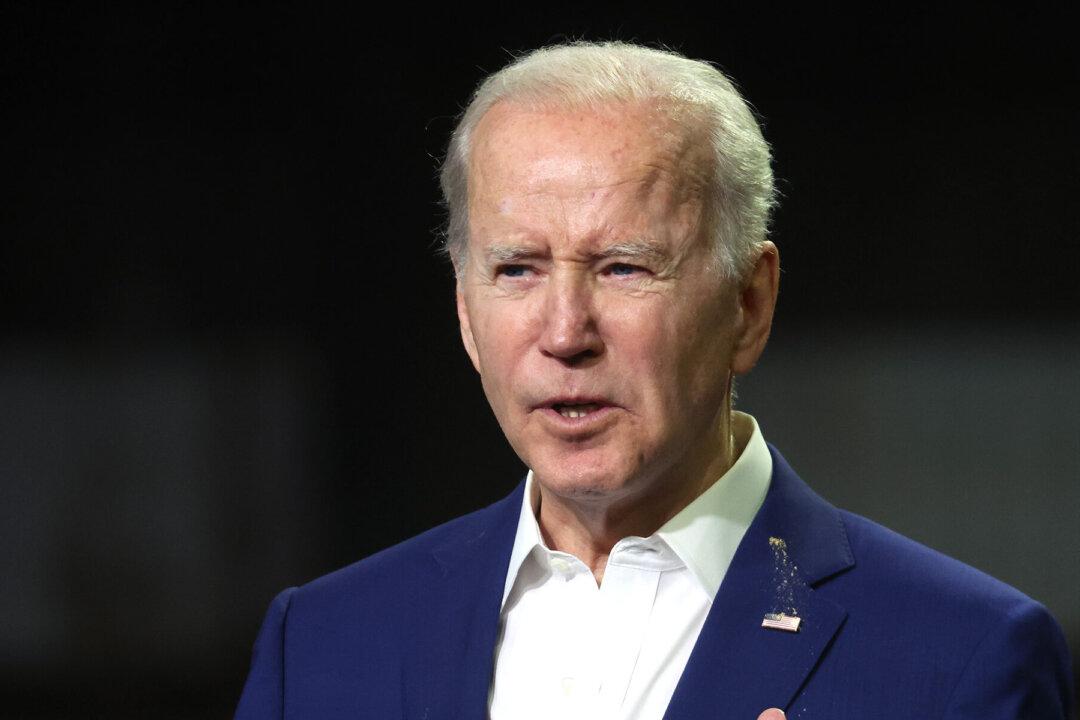

As President Joe Biden signals more actions toward federal student loan debt cancellation, a group of Republican Senators is pushing legislation aimed at preventing him from doing so.

The yet-to-be-numbered bill is sponsored by Senate Minority Whip John Thune (R-S.D.), alongside Sens. Richard Burr (R-N.C.), Mike Braun (R-Ind.), Bill Cassidy (R-La.), and Roger Marshall (R-Kan.). If the legislation is passed as it’s currently outlined, the president or the education secretary won’t be able to cancel outstanding federal student loan balances without the approval of Congress.