WASHINGTON—The senators on the Senate Banking Committee in bipartisan unity denounced the sales culture at Wells Fargo Bank, and, in general, the breach of trust that is fundamental between a bank and its customers.

Investigations by the LA Times, the Los Angeles City Attorney and federal regulators found that some employees opened about two million accounts—deposit and credit card—that may not have been authorized or wanted.

You read that right—two million violations of customers. For the credit cards, they used customer information without their knowledge or consent. Some customers incurred fees due to these actions. These activities have been ongoing since at least 2011.

The pressure on floor sales must have been unbearable for some. The article on Dec. 22, 2013 by the LA Times, “Wells Fargo’s pressure-cooker sales culture comes at a cost,” stated that some employees “begged family members to open ghost accounts.”

This article got the attention of the Office of the Comptroller of the Currency (OCC), the bank’s principle regulator, the LA Attorney office, and, later, the Consumer Financial Protection Bureau (CFPB). The OCC became aware of complaints alleging improper sales practices at Wells Fargo from consumers and bank employees earlier in March 2012, but was slow to take action.

Wells Fargo Chairman and CEO John Stumpf testified under oath at a hearing on Sept. 20. He went through a gauntlet of harsh criticisms for the way Wells Fargo & Co. has handled the sham accounts and harm done to customers. The senators as a whole were exasperated that Stumpf and Wells Fargo senior management have taken so long to fix the problem and seemingly did not act until lawsuits and federal regulators were pressing them. Several senators also voiced strong misgivings that Wells Fargo customers would be compensated for all their monetary losses.

What unnerved several senators was that no one from Wells Fargo senior management has been fired or penalized for many years of fraudulent conduct on a massive scale. Placing the bulk of the blame on low level employees’ misconduct was not persuasive to them.

‘Outrageous’ Conduct

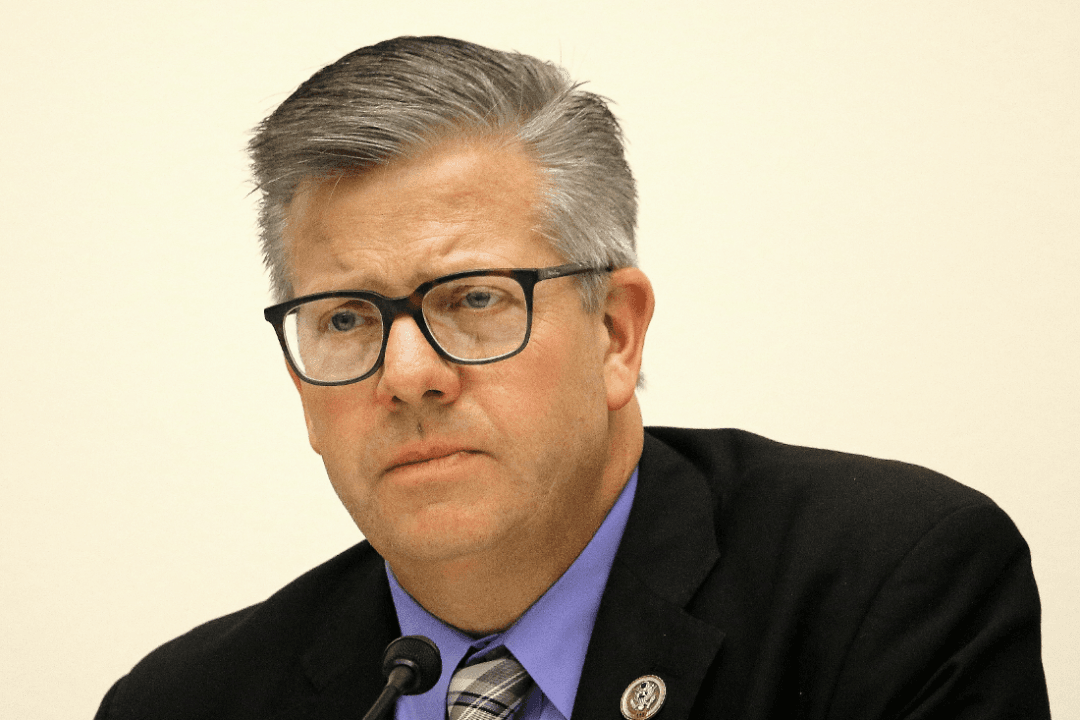

Chief Deputy James Clark, from the Office of the Los Angeles City Attorney testified that it was “outrageous for a bank to use a customer’s private information for any unauthorized purpose, but especially to enhance the bank’s bottom line to the detriment of those with whom it holds a position of trust.”

Clark continued: “It’s outrageous for a bank to open unwanted accounts, and then transfer funds without consent, from that customer’s existing account to fund an unauthorized account.”