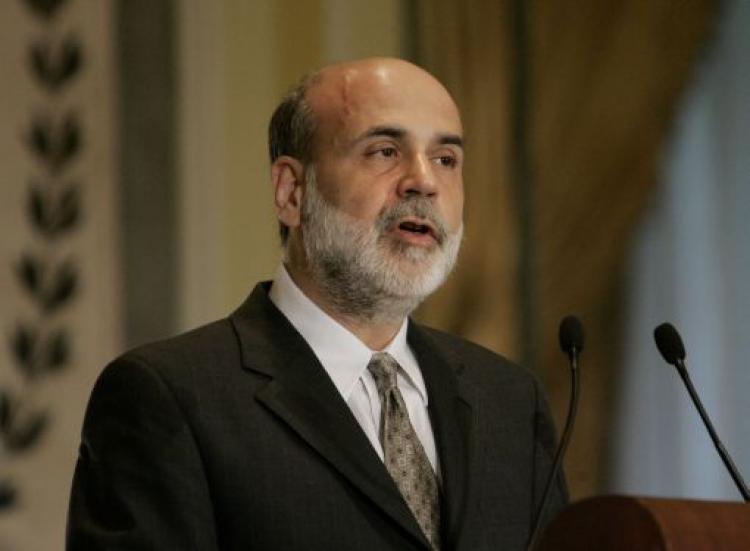

NEW YORK—In a hearing before Congress on Tuesday, Federal Reserve Chairman Ben Bernanke gave a grim forecast for the U.S. economy, against the backdrop of existing mortgage crisis and recent bailout of IndyMac Bancorp by the FDIC earlier this week.

Bernanke Breaks Bad News to Congress

Fed Chairman Ben Bernanke gave his thoughts on the state of the U.S. economy, while the SEC seeks to rein in short sellers.

US Federal Reserve Chairman Ben Bernake speaks, 28 November 2006, before the National Italian American Foundation in New York about the economic direction of the US. Stan Honda/AFP/Getty Images

|Updated: