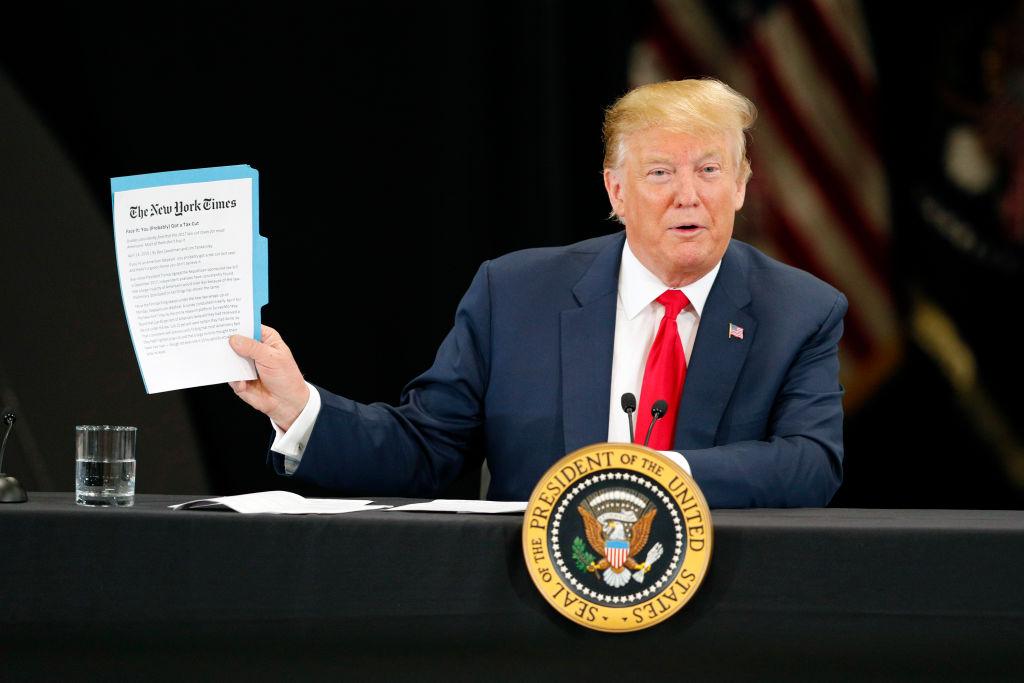

On Tax Day, President Donald Trump touted tax reform and the U.S. economy, saying, “We promised that these tax cuts would be rocket fuel for the American economy and we were absolutely right.”

Speaking at a roundtable event on tax reform in Burnsville, Minnesota, on April 15, Trump called the Tax Cuts and Jobs Act of 2017 the “largest package of tax cuts and reforms in American history.”