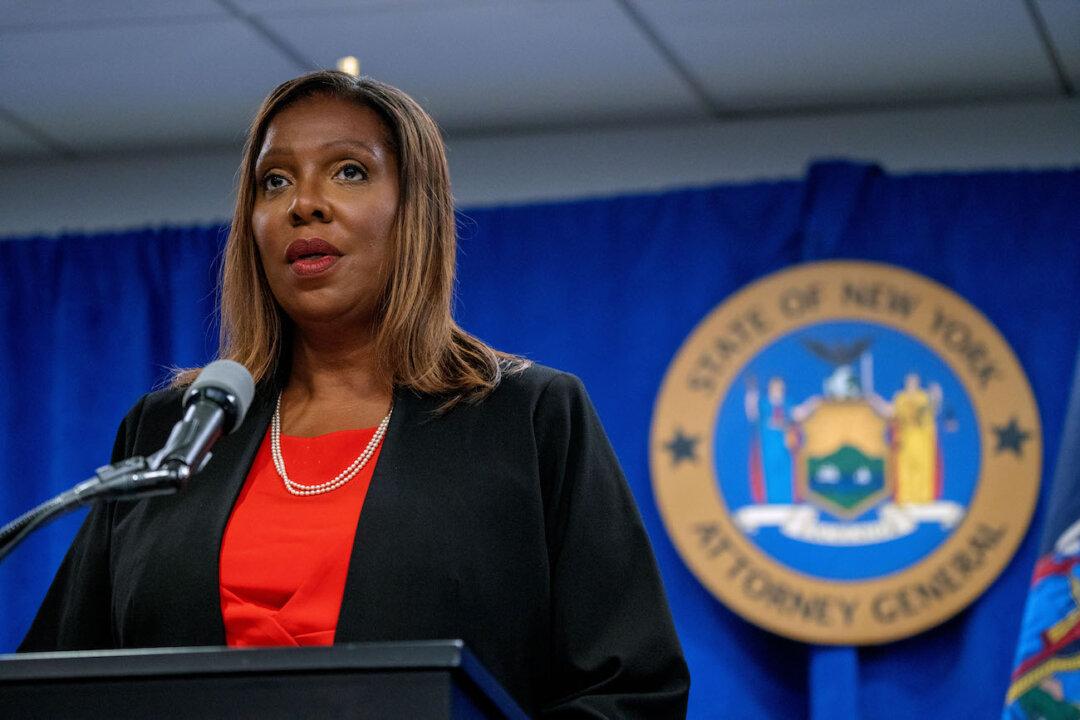

New York State Attorney General Letitia James filed a suit on Oct. 19 against Gemini, a New York cryptocurrency exchange, and Genesis Capital, a cryptocurrency lender, together with founders Barry Silbert and former Genesis CEO Soichiro “Michael” Moro, charging them with “fraudulent schemes.”

An affiliated company, Digital Currency Group (DCG), was also charged in the suit.