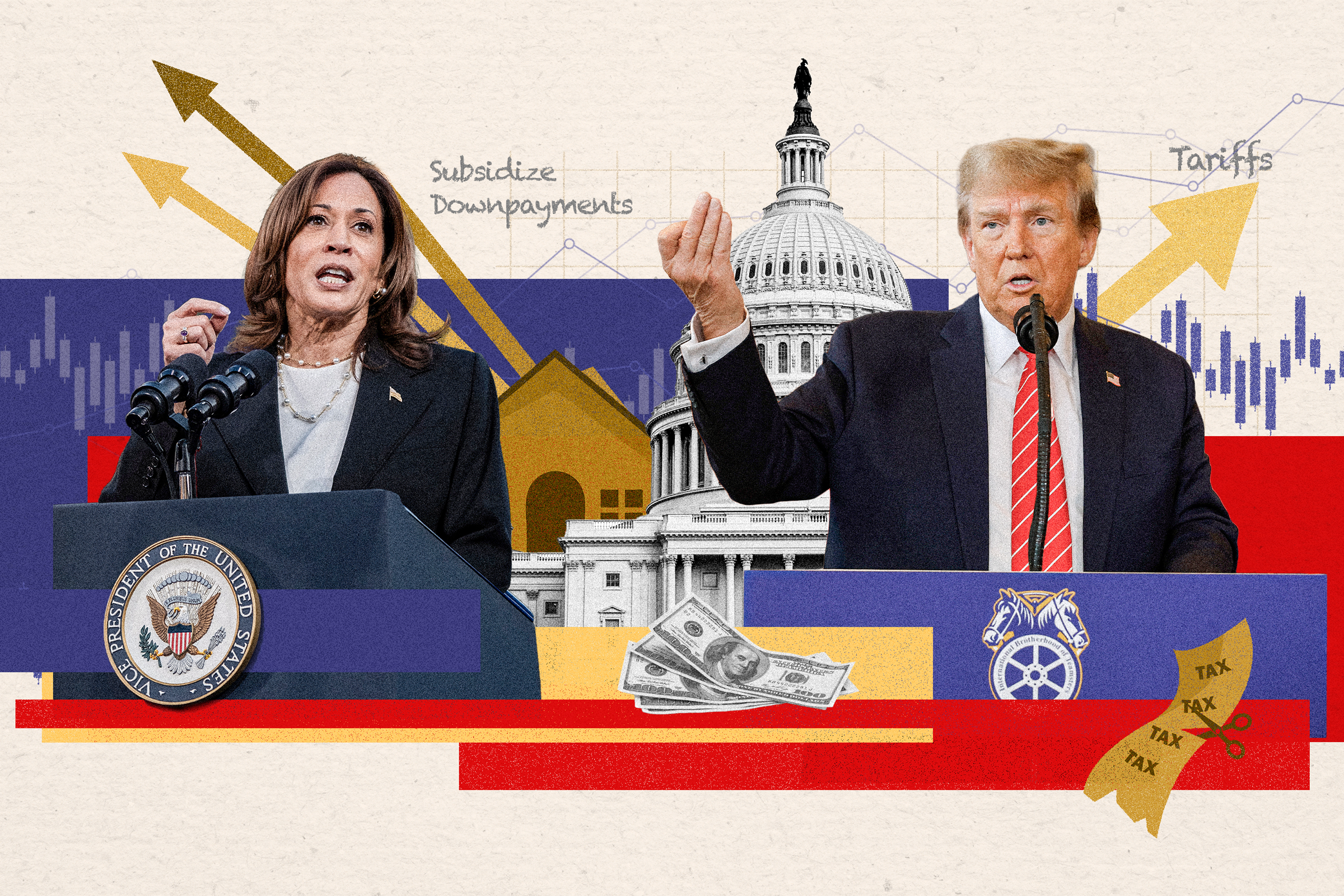

Regardless of who wins the election, the next president likely will have to deal with an economic slowdown next year, several experts told The Epoch Times. They warned that while the government may try to intervene, any remedies could also cause harm.

On paper, the U.S. economy is chugging along nicely. Unemployment is low, the markets are up, and the gross domestic product came in at 3 percent above inflation in the second quarter. Third-quarter GDP is expected to climb 2.6 percent above inflation, and median wages have increased by nearly 2.5 percent (adjusted for inflation) over the past two years.