Good morning, and welcome to The Epoch Times News Brief for Friday, July 5, 2024. I’m Bill Thomas, and as we head into the weekend, there are a number of important stories to share with you.

A district judge in Mississippi pauses the federal government’s revision of Title IX protections nationwide, the Supreme Court rejects a challenge to a federal agency that sets workplace rules, and the Fed may not be done raising interest rates. Also, the IRS says beware of something called climate credit scams, and a very popular weight loss drug could increase risk of vision loss.

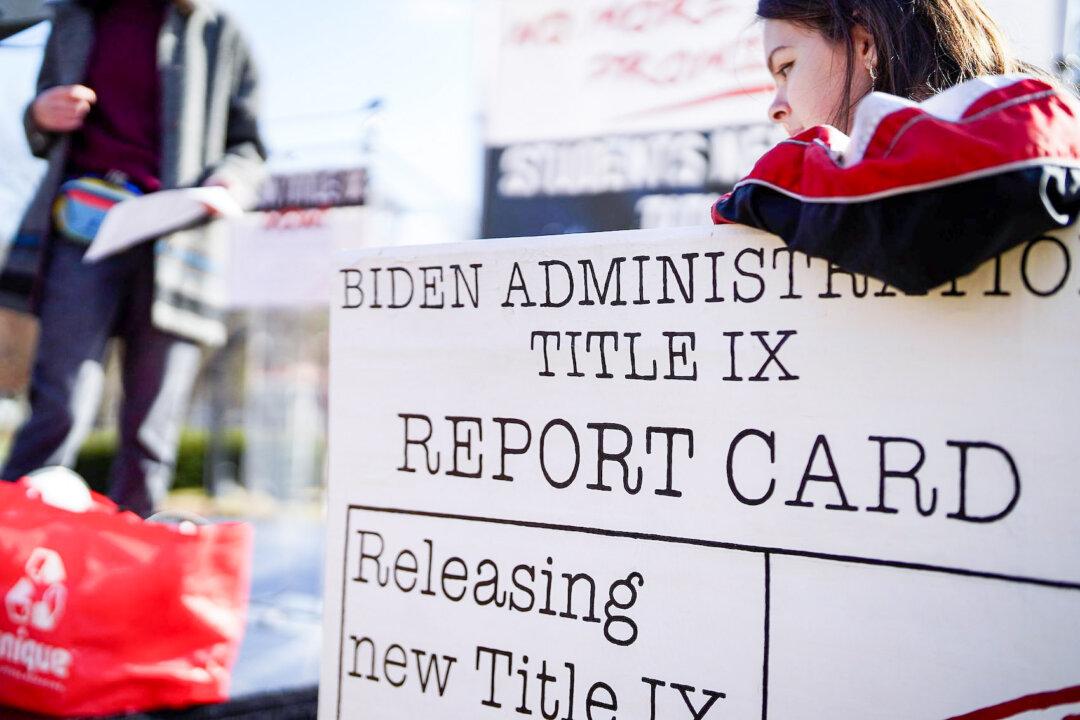

Mississippi District Judge Orders Nationwide Stay on Title IX Gender Identity Revisions

A Mississippi district judge has just ruled that the federal government cannot enforce its reinterpretation of Title IX protections to include gender identity revisions.U.S. District Judge Louis Guirola granted the preliminary injunction and a nationwide stay against Health and Human Services (HHS) revisions to Title IX after hearing arguments by the plaintiffs.

The federal government’s Title IX final rule expanded the law to prohibit discrimination based on sexual orientation and gender identity.

The plaintiffs in up to 15 states, including Alabama, Georgia, Indiana, Louisiana, and Mississippi, filed the complaint in federal court in Mississippi.

HHS Secretary Xavier Becerra said the new rule’s intent was to “strengthen protections” and ensure “equal access to this nation’s health care system and its social service programs for people with disabilities and their families.” He said the agency updated its regulations to prevent “dehumanizing beliefs” surrounding medical treatments and conditions such as gender dysphoria.

The plaintiffs sued, saying the new definition of the rule would require them to use taxpayer funds to pay for unproven and costly gender-transition interventions through Medicaid and state health plans—even for children who could be permanently harmed.

The judge, in ruling against the HHS, said the plaintiffs proved that they would “incur substantial costs” by losing federal funding if they didn’t comply with the Final Rule, which he cited as the deciding factor for his order.

Supreme Court Rejects Challenge to Power of Federal Agency to Set Workplace Rules

The high court denied review of a lower court’s decision that challenged the authority of the Occupational Safety and Health Administration (OSHA) to issue workplace safety standards.The case was brought by Allstates Refractory Contractors against the Labor Department. It stems from a $6,000 fine imposed on the Ohio company by OSHA, which falls under the Labor Department, after a worker was injured on the job.

The company claimed in the lawsuit that when Congress granted OSHA sweeping authority to set “reasonably necessary or appropriate” safety standards, it did so in violation of the constitutional separation of powers principle.

OSHA was granted that power in 1970 when Congress passed the Occupational Safety and Health Act.

The plaintiffs also argued that OSHA—being granted the authority to set safety standards—violated the nondelegation doctrine, which is the principle that Congress cannot delegate its power to legislate to other branches of government.

A lower court ruled against the company, concluding that the delegation of authority to OSHA met the “intelligible principle” test set by the Supreme Court, which is the idea that the delegation must include clear standards and limits to prevent the arbitrary or unchecked exercise of power by any particular agency, in this case the Labor Department.

The 6th Circuit Court of Appeals later upheld the lower court’s decision, leading the company to petition the Supreme Court for review, which the high court denied this week.

Federal Reserve Officials Warn of Rate Hikes If Inflation Persists: Minutes

Federal Reserve officials are sounding the alarm, saying they may raise interest rates if inflation remains elevated or continues to rise. They made those comments when they met last month, according to minutes from the June meeting, which were released on Wednesday.Officials say they’re not ready to cut interest rates until they’re more confident that the nation’s inflation rate is heading toward their 2 percent goal.

On the other hand, they said, if they don’t restore price stability, persistent inflation could lead to tighter financial conditions and worsen household financial positions, especially for lower-income households, which could have a more negative effect on the economy.

Despite everything though, Fed officials say they are more confident they will achieve the 2 percent inflation target following May’s numbers.

Fed Chair Jerome Powell, who spoke this week at a central banking forum in Portugal, said he was pleased by the “bit of progress” in the disinflation process following last month’s inflation figures, but is taking a wait-and-see approach before lowering interest rates.

He went on to say that if they start the process of reducing or loosening policy too soon, they could undo the good work they’ve done, but on the other hand, if they wait too long, they may undermine economic recovery.

All eyes will be on the Fed at their policy meeting in September, when the futures market is expecting a quarter-point rate reduction.

IRS Warns of New Scam Involving Clean Energy Tax Credit

In a notice published this week, IRS officials say they’re seeing cases where fraudulent tax return preparers lie to their clients about claiming clean energy credits under the Inflation Reduction Act (IRA).That 2022 law, which passed as part of the federal government’s billion-dollar initiative to address climate and energy challenges, allows any company in any industry to buy tax credits from developers of wind, solar, and other clean energy projects.

It also allows individual taxpayers to buy tax credits from investments in those projects to offset their federal income tax liability, but there’s a catch. The IRS says an individual buyer’s ability to use those clean energy credits can only be used as a “passive activity” credit to offset tax generated from passive income, and the IRS says most people don’t have a passive income tax liability since most people don’t have a passive income stream.

Here’s how the scam works: fraudulent tax preparers will convince their clients to file returns claiming they have bought IRA credits that can offset income tax from non-passive sources such as wages, Social Security, and retirement account withdrawals. The scammer charges a large percentage fee of the supposed refund from the credits and then disappears—leaving the victim to deal with the consequences, which can be steep.

The IRS says those who claim inappropriate tax credits under the IRA will have to repay the inflated credit, in addition to interest and possible penalties.

The agency goes on to say that if you want to take advantage of the IRA’s clean energy incentives, consult a trusted tax expert to determine whether or not you are actually entitled to use those tax credits.

Ozempic, Wegovy Linked to Higher Risk of Rare Form of Vision Loss, Study Suggests

A new study just published in the medical journal JAMA Ophthalmology says that people who use Ozempic or Wegovy may be at increased risk of developing a rare form of blindness.In the study, researchers looked at whether the risk of non-arteritic anterior ischemic optic neuropathy (NAION) is increased in Type 2 diabetics or overweight or obese patients who are prescribed semaglutide—the generic name for Ozempic and Wegovy.

NAION refers to loss of blood flow to the optic nerve, which connects the eye to the brain. The condition typically causes sudden vision loss in one eye that does not get significantly better or worse.

The researchers, including those at Brigham and Women’s Hospital, the Chan School of Public Health, and Harvard Medical School in Boston, analyzed a study of close to 17,000 patients in the Boston area—none of whom had the eye condition—from December 2017 through the end of November 2023.

They then looked closer at 10 percent of those patients who either had diabetes or were overweight, and compared the frequency of the disease in the individuals who were prescribed semaglutide to those who were not, over a three-year period.

Researchers said their findings “suggest a potential risk of NAION associated with prescriptions for semaglutide” and that further research is needed to confirm a definitive link between the diabetes drugs and the rare form of blindness.

So you know, Danish pharmaceutical company Novo Nordisk, the maker of Ozempic and Wegovy, said the study lacked sufficient data to establish a link between semaglutide and NAION. They went on to say that semaglutide has been studied in large real-world evidence studies and that the totality of data provides reassurance of the safety profile of semaglutide.

We know how seriously you take your health. We share your concern, and that’s why we bring you these very impactful stories.

Looks like our time is just about up for today, so let’s call it a wrap for the Friday edition of The Epoch Times News Brief.

Before we lock up the studio and dive into the much-anticipated weekend, just a reminder: if you have some free time today, we hope you’ll tell some folks you know about our program as we’re always trying to grow our ever-expanding News Brief family, and we are thrilled that you are one of our family members.

Eugenia Spady writes in to say: I like “News Briefs”; time is limited so a summary is always appreciated.

We also heard from Jeffrey in Southern California, Darcy, and my pal Christy checked in to let us know she’s listening in Phoenix, Arizona.

*(Don’t forget the News Brief Motto): We’re portable, affordable, and we’re always on-demand.

And finally, as we do each and every day on this program, we wrap things up with a very “notable” quote:

This one comes to us from the great scientist Albert Einstein, who said: “Learn from yesterday. Live for today. Hope for tomorrow.”

Albert Einstein is widely held to be one of the greatest and most influential scientists of all time.

The Epoch Times News Brief is written by Sharon Reardon with production assistance from Faye, Clare, and a variety of highly talented behind-the-scenes professionals.

For all of us here at The Epoch Times News Brief, I’m Bill Thomas, and thanks a bunch for spending some time with us today. Have an incredible day today, and bye for now.