WASHINGTON—The EMV chip card technology is a great leap forward in credit card security. Many of us consumers have received our new cards with the embedded chip in recent weeks or will receive them shortly. But it will take time before these cards can protect. The majority of small businesses have not made the upgrades to new terminals to read the cards, even though the official deadline passed on Oct. 1.

While there is no government mandate that merchants have to be compliant, there is a strong incentive. As of Oct. 1, noncompliant small businesses, under certain circumstances, became liable for credit card fraud at point-of-sale card transactions.

Many merchants, like perhaps the majority of consumers, are not even aware of EMV chip cards. A Gallup/Wells Fargo survey of 600 small businesses, back in July, found that only 49 percent of small-business owners accepting both debit and credit cards were aware of the Oct. 1, 2015, deadline.

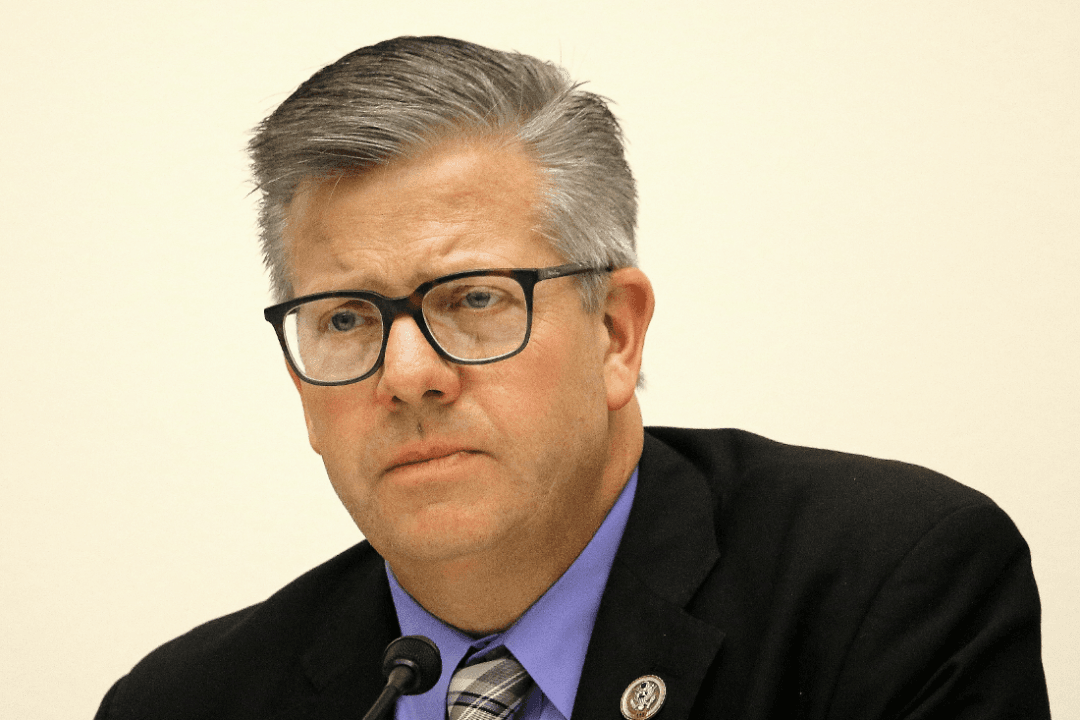

However, that data is old and Oct. 1 has passed. To get an idea of how this transition from the use of magnetic stripe credit cards to ones embedded with a chip is coming along, Chairman Steve Chabot (R-Ohio) of the House Committee on Small Business convened a hearing on Oct. 7. The invited witnesses were from those who process our financial transactions. In a few weeks, the committee will hear from small businesses and retailers.